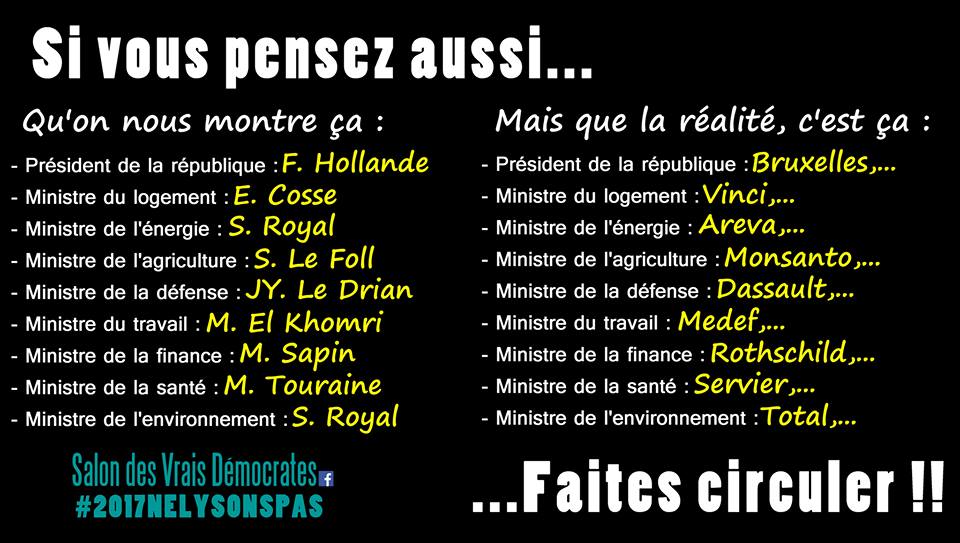

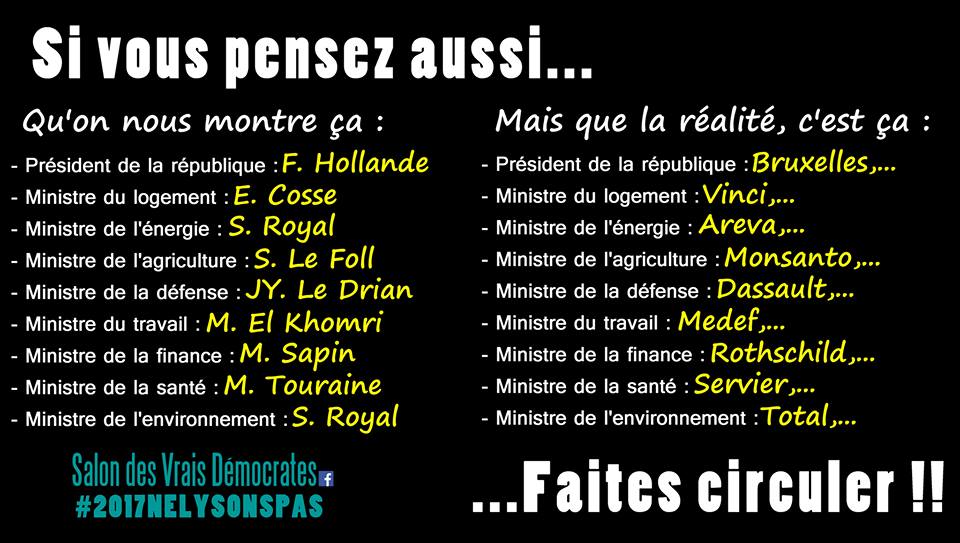

Fraudes électorales & manipulations

par Francois de Siebenthal | Avr 15, 2017 | Uncategorized

Exemples: Il est écrit ci-dessous dans la photo tout en bas : “Aucun rapprochement ne peut être fait entre votre numéro d’électeur et le contenu de votre vote …. ” Faux: URGENT Le principal danger contre notre démocratie, c’est le...

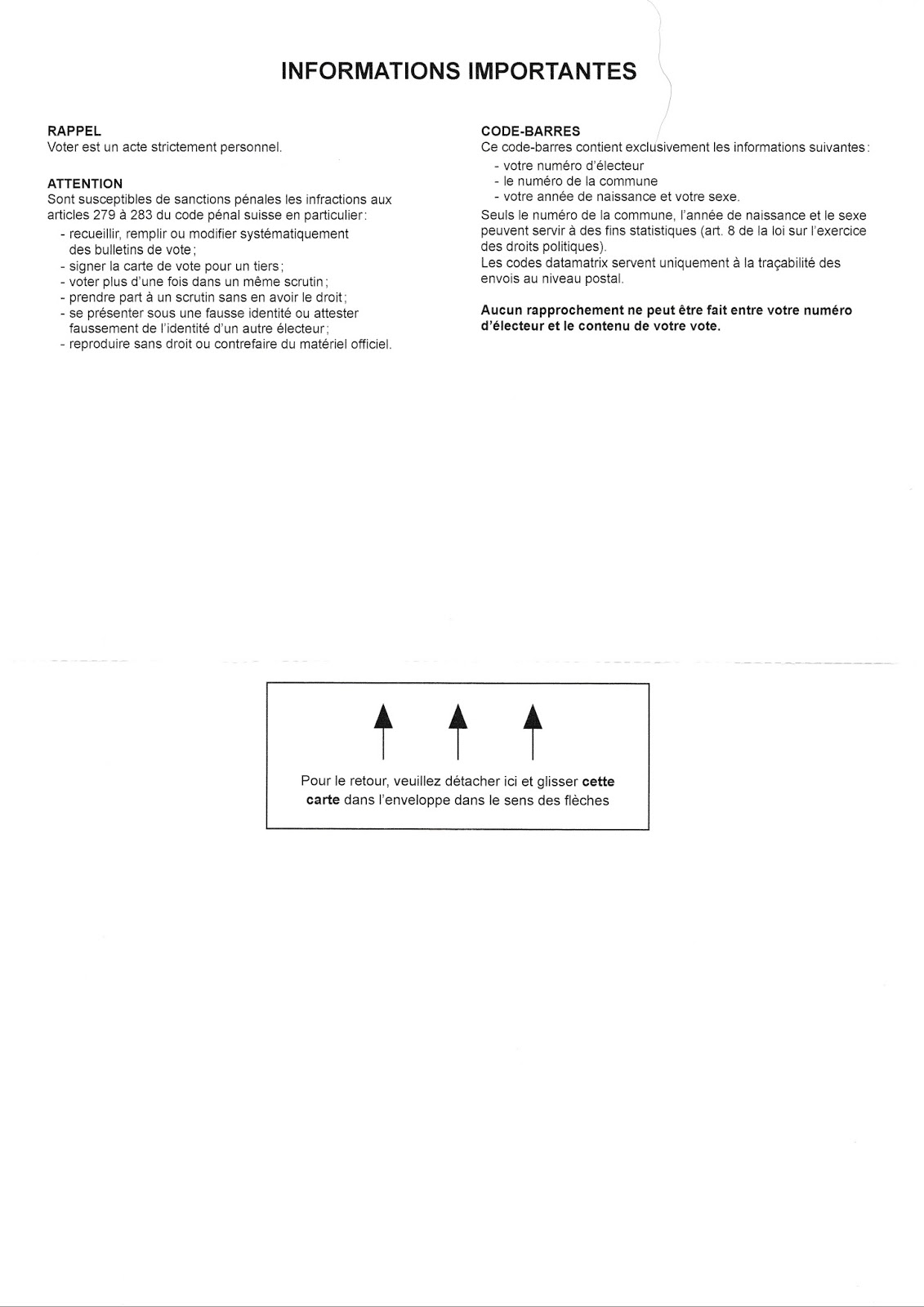

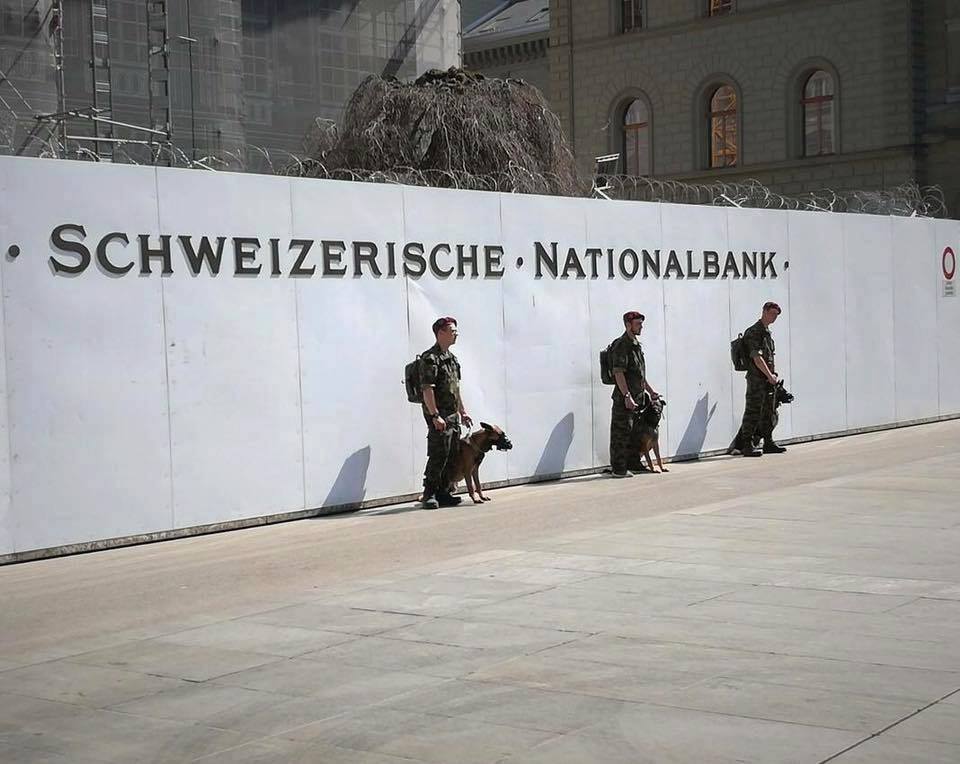

La banque nationale suisse protégée.

par Francois de Siebenthal | Avr 13, 2017 | Uncategorized

La BNS sous haute protection ! L’argent pour les armes tue… http://www.rts.ch/info/economie/8531989-comment-des-tirs-de-missiles-en-syrie-profitent-a-la-banque-nationale-suisse.html Comment des tirs de missiles en Syrie profitent à la Banque nationale...M. Asselineau contre des vaccins

par Francois de Siebenthal | Avr 13, 2017 | Uncategorized

M. Asselineau contre le Tamiflu et Mme R. Bachelot qui a dépensé près de 2 milliards d’Euros, sic… Des enquêtes doivent être menées contre ceux qui provoquent des grandes peurs collectives, notamment contre les laboratoires pharmaceutiques qui profitent...

BNS, autres investissements !

par Francois de Siebenthal | Avr 12, 2017 | Uncategorized

En rouge: Geld für Waffen tötet L’argent pour les armes tue ( notamment l’argent de la BNS dans les armes, y compris nucléaires aux USA ) La BNS sous haute protection ! L’argent pour les armes tue...Articles récents

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Catégories

Pages

- 5G ?

- Accueil

- Activités du site

- Agenda

- Bientôt.

- Cantons

- Contact

- Démocratie directe

- Fraudes

- Gilets jaunes en Suisse

- Groupes

- Invitations

- L’or suisse volé par le FMI et la FED, votez oui pour résister.

- Les chiffres

- Listes

- Logo

- Membres

- Nature.

- Nos actions récentes

- Petition

- Presse

- Résumé:

- Services

- SpiritualitéS

- Vidéos

Indésirable bloqué

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Commentaires récents

- Q SCOOP – François de Siebenthal explique comment on truque les votes et les élections en Suisse. – L'Informateur. dans Fraudes électorales conséquentes en Suisse

- François de Siebenthal dans Révision totale de la constitution suisse

- avreb dans Non-réélection d’Isabelle BIERI

- Martouf dans Serment 2020

- shravaka francois dans Référendum contre la loi coronavirus

Pages

- 5G ?

- Accueil

- Activités du site

- Agenda

- Bientôt.

- Cantons

- Contact

- Démocratie directe

- Fraudes

- Gilets jaunes en Suisse

- Groupes

- Invitations

- L’or suisse volé par le FMI et la FED, votez oui pour résister.

- Les chiffres

- Listes

- Logo

- Membres

- Nature.

- Nos actions récentes

- Petition

- Presse

- Résumé:

- Services

- SpiritualitéS

- Vidéos

Chercher dans les Forums

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Statistiques des Forums

- Comptes enregistrés

- 14

- Forums

- 1

- Sujets

- 10

- Réponses

- 3

- Mot-clés du sujet

- 12

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Chercher dans les Forums

Statistiques des Forums

- Comptes enregistrés

- 14

- Forums

- 1

- Sujets

- 10

- Réponses

- 3

- Mot-clés du sujet

- 12

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Étiquettes

Chercher dans les Forums

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Articles récents

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Groupes

-

Actif il y a 4 ans et 4 mois

-

Actif il y a 4 ans et 4 mois

-

Actif il y a 4 ans et 4 mois

Membres

-

Actif il y a 4 mois et 1 semaine

-

Actif il y a 2 ans et 10 mois

-

Actif il y a 3 ans et 10 mois

-

Actif il y a 3 ans et 11 mois

-

Actif il y a 3 ans et 12 mois

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Commentaires récents