More than 10,000 people are supporting the campaign and we are doing our best to make your voice heard in a debate that is mostly dominated by the financial sector. We are the only European voice representing civil society in monetary policy issues.

» Together we can make a difference. Can you spread the word and invite your contacts to join the campaign?

We wish you a very merry Christmas! See you in 2017!

The Wanderer, January 8, 2008

Should “Social Credit” Be Taken Seriously?

By PAUL LIKOUDIS

In his new book, *In Defense of Human Dignity: Essays on the Just Third Way: A Natural Law Perspective* (reviewed three weeks ago in From the Mail), Michael D. Greaney devotes a chapter to “A Critique of Social Credit,” arguing that the economic theory or “system” developed by English Major C. H. Douglas in the 1920s is not compatible with Catholic social doctrine.

And yet, the Douglas’ “scheme,” especially as further developed by the great French Canadian Catholic lay activist Louis Even and a host of his disciples, including a former mayor of Montreal, is an idea that is growing in popularity around the world, has been adopted by such countries as the Philippines and Madagascar, and was enthusiastically endorsed and recommended as a viable solution to the economic chaos engulfing much of the world now by His Eminence Bernard Cardinal Agre, Archbishop Emeritus of the Archdiocese of Abidan, Ivory Coast at a social action conference in Quebec this past summer.

“Social Credit” has also been the subject of favorable articles published recently in the British journal New Science, as well as by the University of Ottawa based Centre for Research on Globalization.

In an address this past June to the members of the lay action movement founded by Even, the Pilgrims of St. Michael in Rougemont, Quebec, titled “The Social Credit Lessons Are Based on the Social Doctrine of the Church,” Cardinal Agre, who serves on the Pontifical Council for Justice and Peace, explained how the doctrines of Social Credit are in complete accordance with the teachings of the Compendium of the Social Doctrine of the Church, and said he would like to see the Pilgrims of St. Michael have a permanent residence in Rome.

Cardinal Agre was one of four cardinals entrusted by Pope John Paul II to write the Compendium of the Social Doctrine of the Church.

“When you take the ten lessons on Social Credit,” the cardinal said,” they directly originate from the thought that was condensed in the Compendium of the Social Doctrine of the Church; you can fully sense the content of the Social Doctrine and the application of the Gospel in these ten lessons. I believe that we must pay much attention to this.

“You have a goldmine in the Compendium that assembles all what the great Popes spoke and said about society, starting with those who spoke most: Pius XI, Pius XII, John XXIII, Paul VI who also wrote a lot, and John Paul II. It is all of this together that makes the Social Doctrine of the Church. We must remember this.

“Money is not to be rejected, but earned honestly, and one must be careful. I leave you with this phrase: ‘We must dishonor money earned through evil.’ This means that today all the banks create money, but there is clean money and dirty money. Dirty money creates nothing, dirty money of prostitution, of all kinds of evils that we cannot name. It exists, the banks create money. All money that the banks receive is money that is clean and earned, but the money that banks create out of nothing is dirty money…

“Dishonor money that is illgained and ill-employed as well, because money that is ill-employed becomes noxious. That is what you read in the Ten Lessons on Social Credit and other teachings.

“Like everyone else, I came looking for hope. My hope is that no matter what, by dint of talking, educating, creating study circles, we will finally manage to break this law of iron and fire of money, of an international financial house that controls all of us; we will succeed, it is certain…”

To further show his support for the Social Credit movement promoted by the Pilgrims of St. Michael, Cardinal Agre agreed to write the forward for a new edition of the Polish language edition of Louis Even’s book on Social Credit.

In fact, the Social Credit ideas of Douglas and Even almost became law in the United States in 1932, through legislation known as “the Goldsborough Bill,” after Maryland Rep. T. Allan Goldsborough, passed by the House of Representatives, but it was defeated in the Senate after stiff opposition by President Roosevelt and the directors of the Federal Reserve.

As W. E. Turner wrote in Stable Money: A Conservative Answer to Business Cycles ( 1966): “An overwhelming majority of the U. S. Congress (289 to 60) favored it as early as 1932, and in one form or another it has persisted since. Only the futile hope that a confident new President (Roosevelt) could restore prosperity without abandoning the credit money system America had inherited kept Social Credit from becoming the law of the land. By 1936, when the New Deal (Roosevelt’s solution) had proved incapable of dealing effectively with the Depression, the proponents of Social Credit were back again in strength. The last significant effort to gain its adoption came in 1938…”

One supporter in the Senate was Robert L. Owen, Oklahoma from 1907 to 1925 (a national bank director for 46 years), who testified in the House on April 28, 1936: “…the bill which he (Goldsborough) then presented, with the approval of the Committee on Banking and Currency of the House — and I believe it was practically a unanimous report. It was debated for two days in the House, a very simple bill, declaring it to be the policy of the United States to restore and maintain the value of money, and directing the Secretary of the Treasury, the officers of the Federal Reserve Board, and the Reserve banks to make effective that policy. That was all, but enough, and it passed, not by a partisan vote. There were 117 Republicans who voted for that bill (which was presented by a Democrat) and it passed by 289 to 60, and of the 60 who voted against it, only 12, by the will of the people, remain in the Congress.

“It was defeated by the Senate, because it was not really understood. There had not been sufficient discussion of it in public. There was not an organized public opinion in support of it.”

No More Debt

The fundamental doctrine of Social Credit is that money is supposed to be servant, not a master, and it is the responsibility of governments to ensure there is sufficient and stable money in circulation. As Louis Even wrote in his masterpiece, In This Age of Plenty:

“Social Credit tears away the veil which has kept money something almost sacred and untouchable. It makes money a simple servant, and not a master — a god who dictates, permits, or forbids.

“Social Credit maintains that: All that is physically possible and legitimately requested must, by this very fact, be made financially possible.

“If it is possible to build houses, roads, and construct sewage systems, it must be financially possible to pay for the necessary work and materials to build these things. If this is not possible, then one must admit that it is the monetary system that masters man, and not man who masters his monetary system. And since money consists of nothing more than engraved or printed figures, or else handwritten figures in a bank ledger, it is more than stupid and absurd, it is criminal to let families go homeless, towns without public utilities, simply because of a lack of figures…”

In the Introduction to *The Social Credit Proposals Explained in Ten Lessons And Viewed in the Light of the Social Doctrine of the Church,* available on line, Alain Pilote wrote: “Social Credit would neither create the goods nor the needs, but it would eliminate any artificial obstacle between the two of them, between production and consumption, between the wheat in elevators and the bread on the table. The obstacle today — at least in the developed countries — is purely of financial order, a money obstacle. Now, the financial system neither proceeds from God nor nature. Established by men, it can be adjusted to serve men and no more to cause them problems.

“To this end, Social Credit presents concrete propositions. Though very simple, these propositions nevertheless imply a real revolution. Social Credit brings the vision of a new civilization, if by civilization one can mean man’s relationship with his fellow men and the conditions of life making easier for each one the blossoming of his personality.

“Under a Social Credit system, we would no longer be struggling with problems that are strictly financial, which constantly plague public administrations, institutions, families, and which poison relationships between individuals. Finance would be nothing but an accounting system, expressing in figures the relative values of goods and services, making easier the mobilization and coordination of the energies required for the different levels of production towards the finished good, and distributing to ALL consumers the means to choose freely and individually what is suitable to them among the goods offered or immediately realizable…

“Each citizen would be presented with this economic security as a birthright, as a member of the community, enjoying throughout one’s life an immense community capital, that has become a dominant factor of modern production. This capital is made up of, among other things, the natural resources, which are a collective good; life in society, with the increment that ensues from it; the sum of the discoveries, inventions, technological progress, which are an ever increasing heritage from generations…”

The Appendix of Louis Even’s In *This Age of Plenty: A New Conception of Economics”: Social Credit, contains the full report of a committee of nine theologians who were asked to judge whether any of its elements were tinged with socialism or communism. After considerable deliberation, the nine theologians found that Social Credit was not tainted with Socialism nor Communism, and was worthy of close attention.

In the introduction to the 1996 Polish edition of Even’s work, Bishop Zigniew Jozef Kraszewski, wrote: “What Catholics learned in the social doctrine of the Church is the way between socialism and capitalism. For many years, this doctrine has been diffused in Canada, and known as the Social Credit theory. Louis Even’s book, In *This Age of Plenty”, that I introduce to the Polish readers, is an exposition of the Catholic social doctrine that is good not only for the Canadians; this book contains a lot of instructive topics for any person who reads it and who is open to social problems. This book has not been written only for great theoreticians and scholars, but for everybody. That is why this book is precious to the Poles, especially at the time of the second miracle of the Vistula River that we are presently experiencing. (The miracle of the downfall of Communism.)” Poland miraculously succeeded in gaining its freedom and sovereignty. After the

devastation of Communism that had been keeping us captive for so many years, we have the duty to choose the right path of social justice, based on Catholic doctrine. I think this book will largely help in achieving that. I entrust all the readers to the protection of Our Lady Victorious, who reigns in the cocathedral of Kamionku, in Warsaw.”

To learn more about Louis Even and Social Credit, see “The Michael Journal” at: http://michaeljournal.org, which is available in French, English, German, Polish, Spanish, Italian, and Portuguese.

Comments from Joe Thomson

This is the article from Paul Likoudis in the Wanderer that Greaney objected to.

“Its only aim is to remove from these banks the privilege of controlling

credit and money in order to confer that privilege to the State; this is the

only nationalization required.”

Bill, that sentence above was taken from the piece “Social Credit and

Catholicism” that was forwarded in your previous post….

From the way some of the Pilgrims’ literature I’ve seen is written, for

instance, it could easily be taken that “Social Credit” wants to centralize

ALL credit issue into the hands of Government. The quote above could be

interpreted that way, too. This could certainly lead, as it has already

often lead other authors trying to understand Social Credit and explain it

in print, to believe that it is contradictory in its desire to empower the

‘individual’, since a “State” (government) in complete control over all

‘credit’ issue seems inherently ‘socialistic’.

When I read that passage quoted in the Levesque essay, and other material

expressed in a similar way in that essay; and similarly in other sources as

varied as Tutte’s book, Alf Hooke’s “30+5”, and Vic Bridger’s latest “Good

Sense Journal” (pages 11-12, as it could be taken, and has, by John Rawson,

for one), it strikes me that we have got to have some finality over what

such passages really mean.

Either the “State”, as in “Government”, DOES HAVE complete control over ALL

credit issue, i.e. the power to create credit has been completely removed

from the private Banks and vested in some centralised agency, such as a

Reserve Bank, and the private banks are only to be “on-lenders”.

Or, we view the “State”, as I think Douglas intended it to be viewed, as the

“community” of individuals. Where credit-issue remained with the private

banks as now, under public oversight and regulation as with any other

monopoly, of course, but where, within the overall banking system, there

existed an agency to ascertain the necessary ongoing macro-economic

accounting corrections, and a means of distribution of the appropriate

credits to Consumers.

And that this, of itself, would be sufficient to restore the financial

system to proper functionality, with increasing benefits to all.

Until this is settled, I think we’re going to continue to have people like

Greaney, even more ‘honest’ ones than him, trying to reconcile what seems

like a serious contradiction. Or using it against us.

And invariably, as I’ve seen written elsewhere by authors who have no reason

to be prejudiced against it, their view of Social Credit will be that it is

a form of impossible contradictory crankism.

—

Avec mes meilleures salutations.

François de Siebenthal

skype siebenthal

00 41 21 652 54 83

021 652 55 03 FAX: 652 54 11

CCP 10-35366-2

THE COALITION

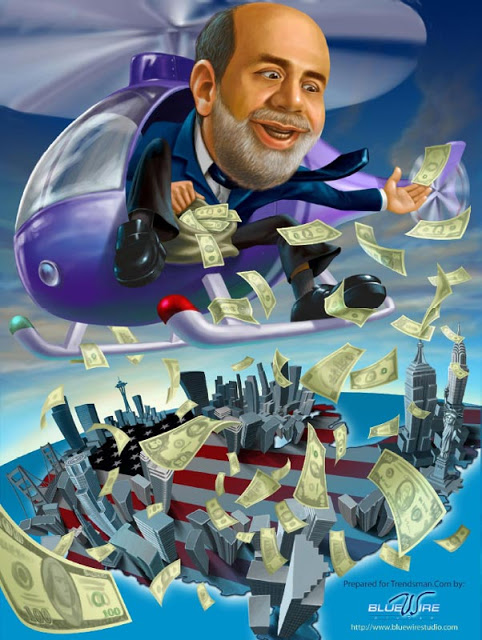

What is Quantitative Easing?

Quick and easy:

Advanced and comprehensive:

Why QE does not work

Quick and easy:

Advanced:

Alternative to QE Proposals

Quick and easy:

Advanced

QE for People

http://www.qe4people.eu/

LE PROJET DE PLATEFORME DIGNITÉ & DÉVELOPPEMENT EST LANCÉ

Union de Fribourg réactualisée

Samedi 5 septembre à l’Université Miséricorde de Fribourg, quelque huitante personnes ont assisté au lancement de la plateforme Dignité & Développement, voulue par Mgr Charles Morerod afin de mettre en commun les acteurs chrétiens qui participent à la réflexion sur les actuels enjeux sociétaux. Diverses thématiques ont été présentées autour desquelles des groupes de réflexion se réuniront pendant trois ans.

Une dizaine de sujets, récoltés en amont auprès d’institutions et de privés, ont été présentés samedi après-midi devant l’auditoire de l’Université de Fribourg, lors d’une conférence interdisciplinaire sur le bien commun. Certains participants s’inscrivent dans la mouvance de la dernière encyclique du Pape (Laudato Si’) et souhaitent aborder l’écologie, y compris dans son lien avec les inégalités sociales. D’autres veulent questionner le droit international : le bien commun en est-il encore le noyau ? et quel est le rôle des religions dans la refondation du droit international relatif à l’être humain ? Ont été aussi proposées des réflexions sur la formation, la responsabilité des acteurs économiques ou encore les enjeux liés au monde du travail : quelle place accorde-t-on, par exemple, aux employés qui aujourd’hui ont été remplacés par des outils informatiques ?

Toute personne intéressée à participer à l’un des groupes de travail ou à proposer d’autres sujets de réflexion peut encore s’annoncer à chancellerie(at)diocese-lgf.ch

Les sujets soulèvent déjà les passions….

Commentaires récents