https://drive.google.com/open?id=1_Wi7FTjb5PJaS0MOoM1XUYBy5KUCXveA

https://www.michaeljournal.org/journal/2018/march/index.html#2/z

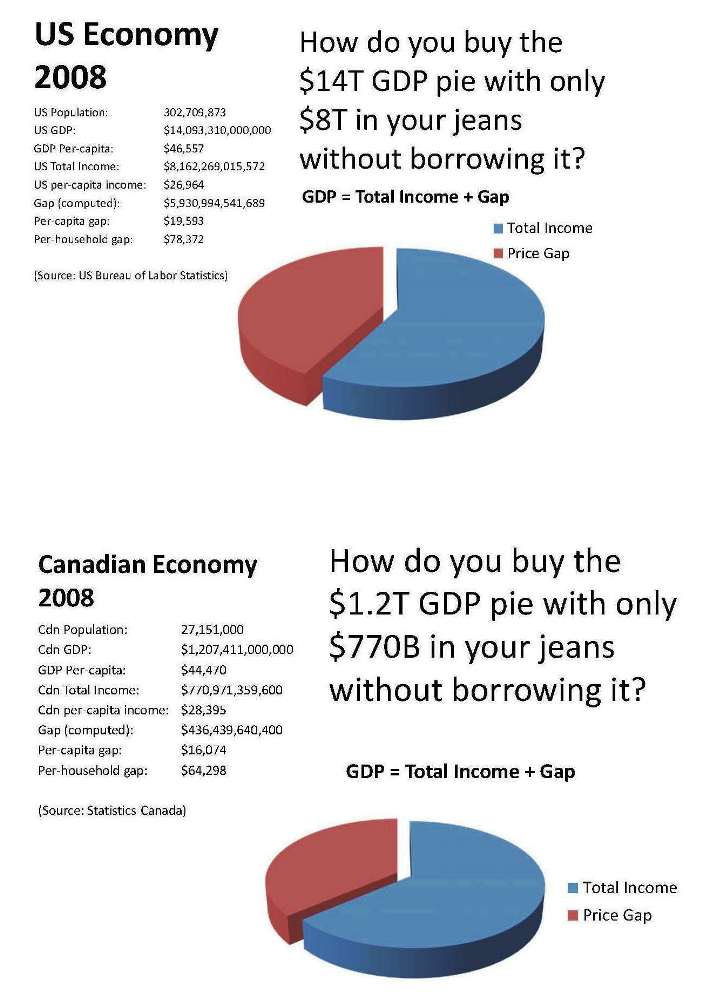

Since we don’t trust government statistics to be accurate, we suspect the integrity of these numbers but they are sufficient to put the problem in perspective and make a start. Another factor that is distorting the numbers is production waste due to “make work” projects, war toys production and planned obsolescence.

http://alor.org/Library/Bridger%20V%20-%20A%20NATIONAL%20BALANCE%20SHEET.pdf

and/or

Social Credit and National Accounting

http://alor.org/Library/Bridger%20VJ%20-%20Social%20Credit%20and%20National%20Accounting.htm

You will find two outlines of such an accounting system.

www.sovereignmoney.eu/digital-currency-and-sovereign-money-accounts

you can find various path-breaking contributions to the current discussion about central bank issued digital cash, including an article on

Monetary Workarounds.

Central bank digital currency and sovereign money accounts. Intermediate approaches to sovereign money reform

at

www.sovereignmoney.eu/monetary-workarounds-digital-currency-and-sovereign-money-accounts.

The paper

Split-Circuit Reserve Banking – Functioning, Dysfunctions and Future Perspectives

at

www.sovereignmoney.eu/split-circuit-reserve-banking

gives a condensed account of how the present bankmoney regime on a fractional base of reserves actually works.

Campaign for Monetary Reform – News from Switzerland

Switzerland is politically unique in this regard as the Swiss Constitution provides a political instrument known as the Volksinitiative (Peoples’ Initiative) which enables Swiss citizens to launch an initiative aimed at changing specific provisions within the Swiss Constitution. To do so requires first of all the collection within an 18 month period of 100’000 valid signatures in support of the initiative. Should this hurdle be surmounted, the initiative would then be put to a national vote.

Preparations for the spring launch are well under way, including the draft proposed amendments to the Swiss Constitution. In a nut shell, the proposal extends the Swiss Federation’s existing exclusive right to create coins and notes, to also include deposits. With the full power of new money creation exclusively in the hands of the Swiss National Bank, the commercial banks would no longer have the power to create money through lending. The Swiss National Bank’s primary role becomes the management of the money supply relative to the productive economy, while the decision concerning how new money is introduced debt free into the economy would reside with the government. As is evident from the foregoing, the MoMo monetary reform initiative is essentially based on the monetary reform advocated by PositiveMoney.

For those interested in following the developments of the campaign, or who would like to understand the detailed provisions, including those relating to the transition period, please refer to the campaign website. The website is in German so language will present a limitation for many of you. Nevertheless, we do encourage you to visit the website and if you have specific questions, to leave a message in English. Someone from the team who speaks English will get back to you. The biggest challenge for the team at this stage of the campaign is to find the needed help and financing for signature collection. The minimum amount of funding required for a successful campaign is estimated to be 400’000 CHF or just over 270’000 GBP. Although, this is a non-UK initaitive, should the MoMo team succeed in putting such a fundamental reform proposal to a national vote, this would be a momentous achievement for the monetary reform movement in Europe and across the globe. All eyes would be fixed on Switzerland, because success for this small but significant player in the financial arena would inevitably have a ripple effect in other countries.

Deutsch >

Danish >

English >

Espanol >

Francais >

Italiano >

Nederlands >

Ungarisch >

1) Financial Times’ Martin Wolf endorses Positive Money’s proposals for reform

“Printing counterfeit banknotes is illegal, but creating private money is not. The interdependence between the state and the businesses that can do this is the source of much of the instability of our economies. It could – and should – be terminated.”

The article includes a concise summary of our proposals and a reference to our book Modernizing Money.

2) Paul Krugman – New York Times

Paul Krugman, American economist, ranked among the most influential economic thinkers in the world today, has written a commentary on Martin Wolf’s article:

Here you can read our response to his commentary:

A Response to Paul Krugman on “Is Banning Banking the Answer?”

3) More debate

Here’s our response:

A reply to Ann Pettifor: Why there will be no “shortage of money”

Josh Ryan Collins, Senior Researcher at New Economics Foundation:

Sovereign money: what it is and why it matters (nef)

Joe Weisenthal, executive editor at Business Insider has written an article with a somewhat misleading title, but addressing the “gross misconception about what a bank does that people tend to have”:

Ban all the banks: Here’s The Wild Idea That People Are Starting To Take Seriously

Our responses coming shortly. Keep an eye on our blogs.

http://www.vollgeld-initiative.ch/english/• The Positive Money Proposal, by Andrew Jackson, Ben Dyson and Graham Hodgson, as of 2 April 2013,

• Explaining Monetary Reform – Presenting the American Monetary Act, brochure by Stephen Zarlenga, American Monetary Institute.

• Sensible Money paper on Resolving the Eurozone Debt Crisis. A Guide to Full-Reserve Banking in the Eurozone (Note: The term full-reserve banking here denotes plain sovereign money in a modern currency system, not 100% reserve).

• Richard A. Werner, How to End the European Financial Crisis – at no further cost and without the need for further political changes, University of Southhampton, CBFSD Policy Discussion Paper No. 3-12.

• Richard A. Werner, How to Turn Banks into Financial Intermediaries and Restore Money Creation and Allocation Powers to the State, University of Southhampton, CBFSD Policy Discussion Paper No. 3-12.

• Stephen Zarlenga on > The Need for Monetary Reform, American Monetary Institute.

• Towards a Twenty-First Century Banking and Monetary System. Submission to the Independent Commission on Banking , 39 pages, 2011, by Ben Dyson (Positive Money), Tony Graham, Josh Ryan-Collins (New Economics Foundation) and Richard A. Werner (University of Southhampton).

A compact presentation of the British monetary reform approach. Its core components are based on the Huber/Robertson proposal of Seigniorage Reform, and by and large it concurs with the monetary reform concepts of the American Monetary Institute, Monetative Deutschland, Vollgeld Switzerland, and others.

Note: Even though the authors used the term ‘full-reserve banking’ at the time, this is definitely not a 100%-reserve approach, but a plan for fully liquid sovereign money beyond the reserve system, thus a new currency approach, not a bank-liability system anymore.

• A New Currency System for the UK according to Positive Money

The Positive Money System (2013)

in plain English, 28 pages

more technical, 35 pages, by Andrew Jackson, Ben Dyson and Graham Hodgson.

• Here you can download > Money and Macroeconomic Dynamics, an accounting system dynamics approach to explain the effects of a sovereign-money system, part IV, by Kaoru Yamaguchi, professor of economics and system dynamics, Japan.

|

and viewed in the light of the social doctrine of the Church; a study prepared by Alain Pilote on the occasion of the week of study that followed the Congress of the Pilgrims of Saint Michael in Rougemont, September 5-11, 2006.

The Social Credit idea may raise many questions among our new readers, and one article is certainly not enough to answer all these questions, or to give a clear understanding of the whole concept of Social Credit. Besides, most people simply do not have the time to read long books on the subject. So, here is the solution: the Social Credit proposals explained in 10 lessons, each one being the logical continuation of the previous one.

|

|

Louis Even’s masterpiece

All those who appreciate Louis Even’s writings on Social Credit will make it their duty to get this book, a masterpiece of logics and clarity. To the new readers of “Michael”, we strongly recommend this book, which gives, in a simple but brilliant way, the best possible explanations on the new conception of economics that Social Credit represents. You can find on line on this site the complete book (50 chapters plus appendices).

410 pages, 14,5 cm x 21 cm, $20 by mail,

from our Rougemont office |

|

The booklet that caused Louis Even

to understand Social Credit

by J. Crate Larkin

It is this booklet that changed the course of the life of Louis Even and made him a Social Crediter in 1934. “It was a great light on my path,” Louis Even said. This 112-page booklet could change your life too! Order it now! The pricfe is $? by mail (Canada and U,S,A,), and $10 international.

|

|

Two booklets on Social Credit by Louis Even

The first booklet, “What Do We Mean By Real Social Credit?”, explains that Social Credit is not a political party, but a series of principles expressed for the first time by engineer Clifford Hugh Douglas in 1918, and that the implementation of these principles would make the social and economic organism effectively reach its proper end, which is the service of human needs. These principles can be implemented by any political party in office, and there is no need of a “Social Credit Party” in power to have them implemented. This booklet is a must for anyone who wants to study Social Credit for the first time, since it contains a very good summary of Social Credit principles (A Primer of Social Credit), and replies to the more widespread objections to this doctrine. The first booklet, “What Do We Mean By Real Social Credit?”, explains that Social Credit is not a political party, but a series of principles expressed for the first time by engineer Clifford Hugh Douglas in 1918, and that the implementation of these principles would make the social and economic organism effectively reach its proper end, which is the service of human needs. These principles can be implemented by any political party in office, and there is no need of a “Social Credit Party” in power to have them implemented. This booklet is a must for anyone who wants to study Social Credit for the first time, since it contains a very good summary of Social Credit principles (A Primer of Social Credit), and replies to the more widespread objections to this doctrine. |

The second booklet, “A Sound And Efficient Financial System”, is for those who have already some notion of Social Credit, but who want to know more about its practicability and technical aspects. It explains Douglas‘s three basic propositions for a sound financial system, and how they could be implemented: how to achieve a constant equilibrium between prices and purchasing power, how to finance private and public production, the financing of distribution through the social dividend to all, and finally, what would become of taxes in a Social Credit financial system. The second booklet, “A Sound And Efficient Financial System”, is for those who have already some notion of Social Credit, but who want to know more about its practicability and technical aspects. It explains Douglas‘s three basic propositions for a sound financial system, and how they could be implemented: how to achieve a constant equilibrium between prices and purchasing power, how to finance private and public production, the financing of distribution through the social dividend to all, and finally, what would become of taxes in a Social Credit financial system.

Two booklets of 32 pages, 21 x 27 cm

$2.00 each (handling and shipping included) |

|

An exceptional offer: three books on Social Credit

To study the cause of the present financial crisis And put an end to poverty amidst plenty  It is urgent to start and form study circles in every country of the world to put an end to the present financial crisis and propose a solution that puts the economic and financial systems at the service of the human person. If we don’t take action, we’ll have a world government and the total loss of our freedom. These three books are: It is urgent to start and form study circles in every country of the world to put an end to the present financial crisis and propose a solution that puts the economic and financial systems at the service of the human person. If we don’t take action, we’ll have a world government and the total loss of our freedom. These three books are:

1. The Social Credit proposals explained in 10 Lessons, viewed in the light of the Social Doctrine of the Church (151 pages); a study prepared by Alain Pilote that is used for our seminars on the occasion of the week of study.

2. In This Age of Plenty (410 pages), by Louis Even, a masterpiece of logic and clarity, with over 50 chapters plus appendices.

3. From Debt to Prosperity (112 pages) by J. Crate Larkin. It is this booklet that changed the course of the life of Louis Even and made him a Social Crediter in 1934. “It was a great light on my path,” Louis Even said.

Since our first goal is to spread the news and educate the population, we offer for a limited time, a special price for these three books (the prices given include the shipping):

There is also a better deal for those who wish to order in large quantities:

And we have a very good deal for those who want to organize study circles: 10 copies of Social Credit in 10 Lessons: 50 dollars; and 90 dollars for 20 copies. Send your cheque or money order to our Rougemont office (1110 Principale St., Rougemont, QC J0L 1M0).

|

What Is Wrong With Our Economy?

Read the following testimony from a Banker. One of the Directors of the Bank of England in the 1920’s, Sir Josiah Stamp, is reputed to have said:

“The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in iniquity and was born in sin. The Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with the flick of the pen they will create enough deposits to buy it all back again. However, take this great power away from them, and all the great fortunes like mine disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of Bankers and pay the cost of your own slavery, let them continue to create money and control credit.”

Ask yourself why we should have such poverty in the land of plenty when technology has brought such incredible production leverage in agriculture and industry. If we run our economy efficiently, we need less than 10-20% of our workforce to produce all of our nation’s goods and services. There are primarily two problems with our economy.

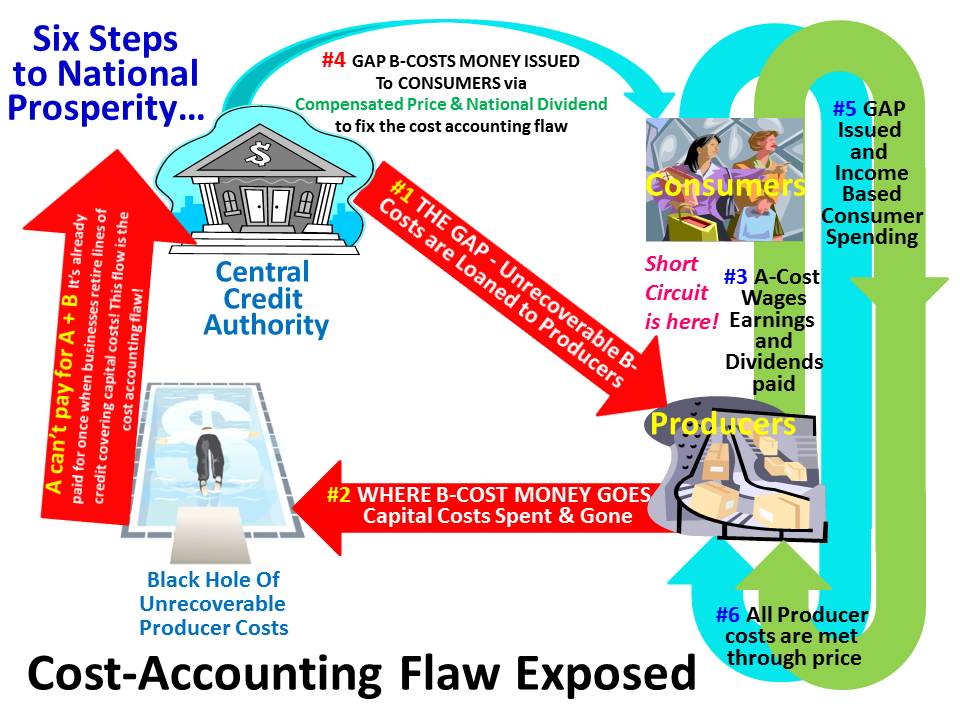

1. The first, and by far the biggest, problem is a

fundamental gap or shortage of purchasing power.

We call this THE GAP.

2. The second problem is unjust usury.

Let us first explore The Gap.

The wealth of the nation is not money. Money is just a piece of paper or a record in a computer file. Our real wealth is the goods and services we produce year in and year out. As that wealth is produced, wages and dividends are created to reward our productivity.

The goods produced and services offered need to have a price set that will allow producers to pay all their costs and earn a profit. That price is comprised of two important components — (a) money paid as wages, earnings, profit and dividends, and (b) all other costs.

If we call the wages the A component and the other costs the B component,

then PRICE = A + B.

The following diagram illustrates The Gap as well as our Solution which we call Wealth Pumps. The A component costs listed in the following diagram are labeled #3, and the Bcomponent costs are labeled #2:

So how big is this gap in the real world?

We will now explore the second problem: Unjust Usury

Almost all money that comes into existence is issued as a debt to someone, and it must eventually be repaid. This debt money is issued by banks in the form of loans in order to fund new issues of stock, mortgages, car loans, various forms of credit, government bonds, treasury bills, etc. The problem is that interest must be paid on this debt; however, the money to cover that interest is never issued. Thus the pool of loan money is like musical chairs where somebody will eventually come up short. One cannot issue a dollar and demand repayment of two without also creating and issuing the second dollar. This is the primary cause of bankruptcy.

It is critical to understand that the first problem, The Gap, is the real problem with our economy; however, it is this second and apparent problem (which is really debt slavery) that everyone can see. This allows the “powers that be” to keep people in darkness because very few have successfully connected the dots. If you can grasp this one simple fact, you will forever be immune to economic deceptions or falling for schemes that lead right back into debt slavery.

It has been said, “Are you a slave? Then be a good slave. However if you can be free, be free!” It is obvious that we have been content to be slaves up to now. The solution to the problems of our economic system is actually simple. Freedom from this economic slavery is not hard to gain if enough people can wake up and take appropriate action. We just need to set a vision in our mind of what is not working, then set another vision of what to replace it with. As surely as the thought “the wood floats” leads to “we have ships,” our new economic vision will lead to a new and better Economic Democracy!

If we think of the way the world’s economies work as being like the game of Monopoly where the banker always wins, the only logical conclusion is to simply change the game. The game we all should instead play is called the Wealth Pumps. In this game, there are no booms or busts, price gaps or taxation. If this sounds impossible to you, there is something you do not know that you need to find out. You need to find out how this new Wealth Pumps game works!

Buy your own personal a copy of my book: Economic Cures “They” Don’t Want You to Know About to get the whole story.

https://drive.google.com/open?id=1_Wi7FTjb5PJaS0MOoM1XUYBy5KUCXveA

https://www.michaeljournal.org/journal/2018/march/index.html#2/z

Commentaires récents