Qui fomente les guerres ?

par Francois de Siebenthal | Juin 29, 2017 | Uncategorized

Gabriel Galice, président de l’Institut international de recherches pour la paix à Genève : “Les Américains ont un plan qui est de remodeler le Moyen-Orient et c’est un projet de prise du pouvoir” Le coup d’état en Syrie organisé dès 2006...

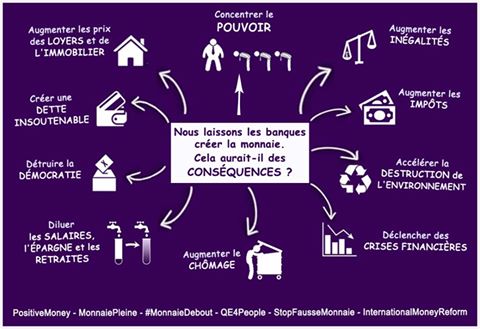

Help us to answer banker’s propaganda, thank you.

par Francois de Siebenthal | Juin 28, 2017 | Uncategorized

Dear Friends of Common Good, Please, help us to answer to the swissbanking.org, Study: “The Sovereign Money Initiative in Switzerland: An Assessement” (EN) thank you 111’111 + Swiss, positive money & social credit Vollgeld is swiss,...

Banksters afraid of resistance !

par Francois de Siebenthal | Juin 28, 2017 | Uncategorized

Dear Friends of Common Good, Please, help us to answer to the swissbanking.org , Study: “The Sovereign Money Initiative in Switzerland: An Assessement” (EN) Thank you 111’111 + Swiss, positive money & social credit Vollgeld is swiss,...

Changer ce système !

par Francois de Siebenthal | Juin 28, 2017 | Uncategorized

de Kassambre (modifié) +Louis Hannetel : ” mais je ne vois pas comment changer ce système” Cet ex banquier suisse ne se contente pas de dénoncer le système bancaire, il se propose de le révolutionner, avec la conviction, soumise à la...Articles récents

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Catégories

Pages

- 5G ?

- Accueil

- Activités du site

- Agenda

- Bientôt.

- Cantons

- Contact

- Démocratie directe

- Fraudes

- Gilets jaunes en Suisse

- Groupes

- Invitations

- L’or suisse volé par le FMI et la FED, votez oui pour résister.

- Les chiffres

- Listes

- Logo

- Membres

- Nature.

- Nos actions récentes

- Petition

- Presse

- Résumé:

- Services

- SpiritualitéS

- Vidéos

Indésirable bloqué

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Commentaires récents

- Q SCOOP – François de Siebenthal explique comment on truque les votes et les élections en Suisse. – L'Informateur. dans Fraudes électorales conséquentes en Suisse

- François de Siebenthal dans Révision totale de la constitution suisse

- avreb dans Non-réélection d’Isabelle BIERI

- Martouf dans Serment 2020

- shravaka francois dans Référendum contre la loi coronavirus

Pages

- 5G ?

- Accueil

- Activités du site

- Agenda

- Bientôt.

- Cantons

- Contact

- Démocratie directe

- Fraudes

- Gilets jaunes en Suisse

- Groupes

- Invitations

- L’or suisse volé par le FMI et la FED, votez oui pour résister.

- Les chiffres

- Listes

- Logo

- Membres

- Nature.

- Nos actions récentes

- Petition

- Presse

- Résumé:

- Services

- SpiritualitéS

- Vidéos

Chercher dans les Forums

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Statistiques des Forums

- Comptes enregistrés

- 14

- Forums

- 1

- Sujets

- 10

- Réponses

- 3

- Mot-clés du sujet

- 12

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Chercher dans les Forums

Statistiques des Forums

- Comptes enregistrés

- 14

- Forums

- 1

- Sujets

- 10

- Réponses

- 3

- Mot-clés du sujet

- 12

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Étiquettes

Chercher dans les Forums

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Articles récents

Sujets récents

- Closed Captioning Services For Movie Videos

- Everyone Wants Interview Transcription Services

- Focusing On The Major Aspects of Book Translation Services

- Everything You Need To Know About Marriage Certificate Translation

- Know The Essential Things That You Get From professional Spanish Subtitling And Other Such Subtitling Services

Groupes

-

Actif il y a 4 ans et 7 mois

-

Actif il y a 4 ans et 7 mois

-

Actif il y a 4 ans et 7 mois

Membres

-

Actif il y a 2 mois

-

Actif il y a 3 ans et 1 mois

-

Actif il y a 4 ans et 1 mois

-

Actif il y a 4 ans et 2 mois

-

Actif il y a 4 ans et 3 mois

Archives

- mai 2021

- août 2020

- juillet 2020

- juin 2020

- mai 2020

- avril 2020

- mars 2020

- février 2020

- janvier 2020

- décembre 2019

- novembre 2019

- octobre 2019

- septembre 2019

- août 2019

- juillet 2019

- juin 2019

- mai 2019

- avril 2019

- mars 2019

- février 2019

- janvier 2019

- décembre 2018

- novembre 2018

- octobre 2018

- septembre 2018

- août 2018

- juillet 2018

- juin 2018

- mai 2018

- avril 2018

- mars 2018

- février 2018

- janvier 2018

- décembre 2017

- novembre 2017

- octobre 2017

- septembre 2017

- août 2017

- juillet 2017

- juin 2017

- mai 2017

- avril 2017

- mars 2017

- février 2017

- janvier 2017

- décembre 2016

- novembre 2016

- octobre 2016

- septembre 2016

- août 2016

- juillet 2016

- juin 2016

- mai 2016

- avril 2016

- mars 2016

- février 2016

- janvier 2016

- décembre 2015

- novembre 2015

- octobre 2015

- septembre 2015

- août 2015

- juillet 2015

- juin 2015

- mai 2015

- avril 2015

- mars 2015

- février 2015

- janvier 2015

- décembre 2014

- novembre 2014

- octobre 2014

- septembre 2014

- août 2014

- juillet 2014

- juin 2014

- mai 2014

- avril 2014

- mars 2014

- février 2014

- janvier 2014

- décembre 2013

- novembre 2013

- octobre 2013

- septembre 2013

- août 2013

- juillet 2013

- juin 2013

- mai 2013

- avril 2013

- mars 2013

- février 2013

- janvier 2013

- décembre 2012

- novembre 2012

- octobre 2012

- septembre 2012

- août 2012

- juillet 2012

- juin 2012

- mai 2012

- avril 2012

- mars 2012

- février 2012

- janvier 2012

- décembre 2011

- novembre 2011

- octobre 2011

- septembre 2011

- août 2011

- juin 2011

- mai 2011

- avril 2011

- mars 2011

- février 2011

- janvier 2011

- décembre 2010

- novembre 2010

- octobre 2010

- septembre 2010

- août 2010

- juillet 2010

- juin 2010

- mai 2010

- avril 2010

- mars 2010

- février 2010

- janvier 2010

- décembre 2009

- novembre 2009

- octobre 2009

- septembre 2009

- août 2009

- juillet 2009

- juin 2009

- mai 2009

- avril 2009

- mars 2009

- février 2009

- janvier 2009

- décembre 2008

- novembre 2008

- octobre 2008

- septembre 2008

- août 2008

- juillet 2008

- juin 2008

- mai 2008

- avril 2008

- mars 2008

- février 2008

Commentaires récents