Why ?

Because they create the capital in an unlimited way out of nothing,

then,

if you create an infinity of capital, the interest rate becomes itself

infinite, and this lead to an infinite economical war, killing millions

of the poorer.

They lie to everybody all the times since a long time. They cheat all balances…

The different

guise is this money creation out of nothing allowing them to infinite control of everything and everybody and every souls.

mischief has been increased by rapacious usury, which, although more

than once condemned by the Church, is nevertheless, under a different

guise, but with like injustice, still practiced by covetous and grasping

men….

NO limits in money creation…by Dr. Pinar Yesin, University of Zurich

countries have NO limits in money creation…by Dr. Pinar Yesin,

University of Zurich, i.e. a 0 ( zero, none ) limit, that means

private banks can create debts with interests as much as they

can…..leading to unfair competition and crisis… and wars…

| Country | Required reserve ratio/% | |

|---|---|---|

| Australia | None | |

| Canada | None | |

| Mexico | None | |

| Sweden | None | |

| United Kingdom | None |

Other countries have required reserve ratios (or RRRs) that are

statutorily enforced (sourced from Lecture 8, Slide 4: Central Banking

and the Money Supply, by Dr. Pinar Yesin, University of Zurich ( based

on 2003 survey of CBC participants at the Study Center Gerzensee[2] ):

In

crisis times, value ot many assets are collapsing but most debts are

kept intact thanks to the support of the politicians to the bankers,

leading to more troubles in all the others segments of the populations.

Politicians will protect taxes to be sure to have better conditions for themselves and for the bankers.

Most

taxes are going first to pay the huge and insane salaries of the

bankers. Who are the real owners of all those very huge amounts,

trillions and trillions ??? ). What do they do with ? Wars ?

Manipulations ? Viruses ?

Dear Francois,

You are absolutely correct about the banks having the right to

create “credit” with its corollary of “Interest Bearing Debt to

the creator”, such creation functioning as “Money” wherever it is

used. New Zealand Ministers of the Crown, like expert

witnesses in Commission Hearings and investigations are currently

acknowledging that only around 3% of the national so-called

“M1” Money Supplies exist as legal tender created by central

government administrations.

admits that the other 97% of the official “Money Supply” has

been created out of nothing as debt by , and to , the banking system,

by the members of that sector. Put another way, the figures in

computers that currently function as “Money” are just

reflections of debts owed by individuals, enterprises, and all

local and central governments, to members of the Finance Sector;

mainly the Banks.

the late President Abraham Lincoln stated , ” If the American people

ever discover how the finance system really works, there will be a

revolution before breakfast ” , he was dead serious. It is fear

of this contingency which causes the Finance Sector, and all the

parties which, for whatever reasons want the present privileges

and arrangements to continue , that motivates their unofficial

representatives to accept all sorts of conventions and apparent

restrictions to continue. Such concessions, even extending to the

payment of interest on deposits with lending institutions of all

kinds, are accepted because they not only confuse the issue, they

appear to “prove” that banks lend their deposits. Factually, all

they do is prop up the “Myth” of deposit lending, which all

supporters of the Debt Finance System hide behind; some for reasons

of complicity, and others through outright ignorance.

the right to create and own national money supplies is reclaimed

by representative governments, and spent into circulation by them,

without debt, but limited to the proper balance with the

circulating value of Goods and Services, then the legal extortion

by the Finance Sector will continue. Only then will it be

possible for we human beings to have and enjoy the wealth we

are creating , using currently

Dear Francois,

You are absolutely

correct about the banks having the right to create “credit” with its

corollary of “Interest Bearing Debt to the creator”, such creation

functioning as “Money” wherever it is used. New Zealand

Ministers of the Crown, like expert witnesses in Commission

Hearings and investigations are currently acknowledging that only

around 3% of the national so-called “M1” Money Supplies exist as

legal tender created by central government administrations.

This

admits that the other 97% of the official “Money Supply” has

been created out of nothing as debt by , and to , the banking system,

by the members of that sector. Put another way, the figures in

computers that currently function as “Money” are just

reflections of debts owed by individuals, enterprises, and all

local and central governments, to members of the Finance Sector;

mainly the Banks.

When the late President Abraham Lincoln stated ,

” If the American people ever discover how the finance system really

works, there will be a revolution before breakfast ” , he was dead

serious. It is fear of this contingency which causes the Finance

Sector, and all the parties which, for whatever reasons want the

present privileges and arrangements to continue , that motivates

their unofficial representatives to accept all sorts of conventions

and apparent restrictions to continue. Such concessions, even

extending to the payment of interest on deposits with lending

institutions of all kinds, are accepted because they not only confuse

the issue, they appear to “prove” that banks lend their deposits.

Factually, all they do is prop up the “Myth” of deposit

lending, which all supporters of the Debt Finance System hide

behind; some for reasons of complicity, and others through outright

ignorance.

Until the right to create and own national money

supplies is reclaimed by representative governments, and spent into

circulation by them, without debt, but limited to the proper

balance with the circulating value of Goods and Services, then the

legal extortion by the Finance Sector will continue. Only then

will it be possible for we human beings to have and enjoy the

wealth we are creating , using currently

available resources, without mortgaging our children to the Banking Sector. We need another Abe Lincoln.

So writes Don Bethune of Godzone (New Zealand)

countries at the top have a 0 ( none) limit, that means they can

create as much as they can…..leading to unfair competition, crisis,

revolution. slavery… and wars…

Country  |

Required reserve ratio/%  |

Note  |

|---|---|---|

| Australia | None | |

| Canada | None | |

| Mexico | None | |

| Sweden | None | |

| United Kingdom | None |

Other countries have required reserve ratios

(or RRRs) that are statutorily enforced (sourced from Lecture 8, Slide

4: Central Banking and the Money Supply, by Dr. Pinar Yesin, University

of Zurich (based on 2003 survey of CBC participants at the Study Center

Gerzensee[2]):

http://en.wikipedia.org/wiki/Fractional-reserve_banking

http://en.wikipedia.org/wiki/Money_creation

- Money as Debt website

- Money as Debt on Google Video

- Podcast interview with Paul Grignon about the film (from BSAlert.com)

http://paulgrignon.netfirms.com/MoneyasDebt/references.htm

If concepts are not right, the words are wrong,

and if the words are wrong, works cannot be achieved.

Confucius

This prophetic mail was sent in April 2008, copy for you

More

and more robots and computers will produce most of the goods. less and

less human will be necessary to produce what is neccesary to live, the

problem is how to distribute the money to buy all goods on the market ?

Do not accept a centralized system, go the swiss way. Small is beautiful.

Say no to more taxes.

Robert A. Heinlein described a Social Credit economy in his first novel, For Us, the Living (published in 2003, but apparently written ca. 1939). (Beyond This Horizon

describes a similar system, but in less detail.) The society in the

book uses a method to prevent inflation: the government makes a deal

with business owners. Instead of increasing prices, they cut prices, and

the government (or the Bank of the United States) pays them the

difference after seeing their sales receipts. Like the guaranteed income

or heritage checks, this money comes out of the inkwell. In the future,

the government no longer uses taxation to fund itself. The characters

point out that present “fractional reserve” law allows banks to create

money (by loaning out many times more money than they have on hand),

while in Heinlein’s future society only the US government can create US

currency.

Robert Anton Wilson proposed another form of Social Credit. His plan aimed to end wage slavery,

and began by offering a reward to any worker who designed

him-or-herself out of a job. The guaranteed income (or, in the

Schrödinger’s Cat Trilogy, a lesser reward to all other workers who

“lose” their jobs to innovation) would prevent starvation. This income

would consist of “trade aids” which would lose numerical value with the

passage of time. This official reduction in value would encourage

spending and (although Wilson does not state this explicitly) limit

price inflation. Elsewhere, Wilson attributed this strategy to Silvio Gesell,

who also suggested the government encourage small communities to

experiment with alternate economic models. If one of these enclaves

seemed especially successful, the country could copy their model in

place of Gesell’s own plan.

Switzerland:

English priest named Father Drinkwater, wrote a book in 1935 that

identified this “devouring usury under another form” that is the

monopolization of credit, which was to amount more and more to a

monopolization of money, although the workings of this monopolization of

credit were still mysterious to almost everyone at that time.

Drinkwater recorded that a committee based at the University of Fribourg,

Switzerland, had prepared some elements for the drafting of Rerum

Novarum, and that among the members of this committee there was at

least one person from Austria who was well aware of the money question and

of bank credit. A text that this Austrian had prepared and that was

apparently approved by the committee, showed clearly how mere bank money–which

is created in banks and consists basically of figures written in

bank-books and ledgers, and which was already becoming the major monetary

instrument for trade and industry–was nothing but the monetization of

the production capacity of the whole community. The new money thus created

can only be social in nature (belonging to all of society), and not the

property of the bank. This new money is social because of its basis: the

community, or society, and because it can buy any good or service in the

country. The control of this source of money therefore puts in the hands

of those who exercise it, a discretionary power over all economic life.

text of this Austrian expert also showed that banks do not lend their

depositors’ money, but rather deposits that they create out of nothing

simply by inscribing figures in bank-books. When banks lend money–no

account is diminished in the bank–they do not have to extract one penny

from their safes. So the interest charged on their loans is certainly

usury: whatever its rate–it is actually more than 100%, since it is

interest charged on a capital of zero, nil–the lender (the bank) does

not have to do without the money he lends, he just creates it! This usury

can rightly be described as “devouring”, since banks require

creditors to pay back money that has never been created, that has never

been put into circulation. (Banks create the principal they lend, but not

the interest.) It is therefore mathematically impossible to pay back all

loans; the only way for the economy in such a system to keep going is to

borrow again to pay the interest, which creates un-repayable private and

public debts.

was the exact wording of this text about the monopoly of credit? One

cannot know, since there is no mention of it in the encyclical. Was it

suppressed in Fribourg in the final draft sent to Rome? Was it stolen

between Fribourg and Rome, or between its arrival in Rome and its delivery

to the Sovereign Pontiff? Or was it Pope Leo XIII who decided to put it

aside? Fr. Drinkwater raises these questions, but gives no answer. End of

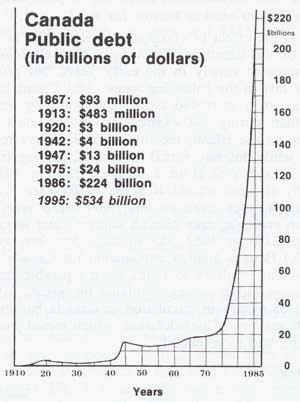

quote. This scandal is producing the same absurd situation as in Canada.

finally let us quote Mackenzie King, who stated while he was campaigning

to become Prime Minister of Canada in 1935: “Until the control of the

issue of currency and credit is restored to government and recognized as

its most conspicuous and sacred responsibility, all talk of the

sovereignty of Parliament and of democracy is idle and futile.”

more graphs depicting our financial situation see our webiste: http://www.michaeljournal.org/images/croisdet2.gif

and

http://www.michaeljournal.org/images/debtcan.jpg

Dear FrankFollowing your message.

Hello Francois. Would you be so kind as to view this and share your insights with us? There is something here.

FM

My comments:Bad translations from Rome.Example in the recent papal encyclical Caritas in Veritate…

Pawnbroking is not monte di pietà…Can we translate the concept hospital by bordel or brothel or whorehouse?65. … Furthermore, the experience of micro-finance, which has its roots in the thinking and activity of the civil humanists — I am thinking especially of the birth of pawnbroking —

should be strengthened and fine-tuned. This is all the more necessary

in these days when financial difficulties can become severe for many of

the more vulnerable sectors of the population, who should be protected

from the risk of usury and from despair. The weakest members of society

should be helped to defend themselves against usury, just as poor

peoples should be helped to derive real benefit from micro-credit, in

order to discourage the exploitation that is possible in these two

areas. Since rich countries are also experiencing new forms of poverty,

micro-finance can give practical assistance by launching new initiatives

and opening up new sectors for the benefit of the weaker elements in

society, even at a time of general economic downturn.

Real translation and its importance:

A

mount of piety is an institutional pawnbroker run as a charity in

Europe from the later Middle Ages times to the 20th century, more often

referred to in English by the relevant local term, such as monte di

pietà (Italian), mont de piété (French), or monte de piedad (Spanish).

In

Switzerland, e.g. the cantons of Bern and Zürich enacted elaborate

laws for the regulation of the business. In Zürich the broker must be

licensed by the cantonal government, and the permit can be refused only

when the applicant is known to be a person underserving of confidence.

Regular books have to be kept, which must be at all times open to the

inspection of the police, and not more than 1% interest per month may be

charged, just to cover the costs and not for profits, as asked by the

Church, i.e. permitted by Medici Pope Leo X’s

usury-for-a-good-cause: the Monte di pieta, so-called “charity banks”

operated in the Renaissance in the name of the poor, with no profits. A

loan runs for six months, and unredeemed pledges may be sold by auction a

month after the expiration of the fixed period, and then the sale must

take place in the parish in which the article was pledged. No more than

two persons at a time have ever been licensed under this law, the

business being unprofitable owing to the low rate of interest. In the

canton of Bern there were once two pawnbrokers. One died and the other

put up his shutters. The Zürich cantonal bank, however, conducts a

pawnbroking department, which lends nothing under 4s. or over £40

without the special sanction of the bank commission. Loans must not

exceed two-thirds of the trade value of the pledge, but 80% may be lent

upon the intrinsic value of gold and silver articles. The swiss

establishments make practically no profit.Fribourg in Switzerland and Rerum Novarum,3…The

mischief has been increased by rapacious usury, which, although more

than once condemned by the Church, is nevertheless, under a different

guise, but with like injustice, still practiced by covetous and grasping

men….Hunger

in the world, population growth, wars, bad distribution of wealth, and

the ever-increasing gap between the rich and the poor, call for a

neutral and objective reflexion. We admit that there will always be

disparities, but the present situation calls for urgent solutions, and

most of the problems are yet to receive any beginning of efficient

realization, except for a few rare exceptions.After

years spent studying the recent demographic phenomena, and because of

their relationship with the present banking crisis, I can affirm that

the following facts are of the utmost importance, their seriousness

having been anticipated by only a few civilizations in the past. The

non-respect of natural laws inscribed in nature will cost a high price,

and the more we wait, the higher the bill will be for us, our children,

and our grandchildren.The main factsThe

present demographic crisis in Europe is the most serious in history.

One of the worst situations is that of Italy, with an average fertility

rate of 1.2 children per woman, even 0.8 in Northern Italy. Soon Spain

will beat Italy in this demographic pit. In the near future, Europe will

have to consecrate more than half of its Gross National Product to the

elderly. The European States will be ruined because of the lack of young

people. The European economy is already declining. In an absurd

reaction against this, some voices are raised in the mass media to

promote the active euthanasia of the elderly and disabled. (Laws along

this line have already been voted in in Zurich and the Netherlands.)Most

of the Western Nations can no longer manage to pay the interest on

their debts nor control them, to the detriment of primary tasks. For

example, Italy is socially bankrupt because of its taxes. There is

widespread corruption, a decline of the GNP, the failure of the school

system, young people on drugs, and the ever-increasing cost of health

care (more than 50 billion Swiss francs in Switzerland alone): all of

these facts carry a heavier burden on society. National pensions plans

are going bankrupt.The productivity due to robots and computers could save us, but it will have to be redistributed in a just way.The role of credit and its demographic consequencesToday’s

economy is based on loans. The public does not know that banks take

huge liberties with the loans they make. If, for example, there are 100

dollars in deposits, the U.S. banking system lends a hundred times this

100 dollars, which makes $10,000, or a creation of $9,900 out of

nothing. This creation of money is possible thanks to the trust in the

banks and the law of large numbers, which says that it is never all of

the depositors who will withdraw their savings at the same time. The

globalization of the world economy aggravates this situation of the

“miraculous” creation of money by the banks, which creates skyrocketting

debts.Since

human nature has its limits, many people have begun to realize the

limit of this system of the creation of money out of thin air, and its

human cost, especially regarding unborn babies. There is a shortage of

babies in every western nation, and the present crisis is due to this

shortage. If all the depositors in the world wanted to withdraw their

savings all at once, there would be a huge financial crisis. This is

going to happen in developed nations because of the ageing of the

population. We should be smart enough to prevent this fall, and prepare

alternative solutions, by favoring families.The role of interest ratesThrough

sudden raises of the interest rates and money creation, banks become

gradually the owners of the real wealth of the nations, since all the

fictitious money they lend has to return to them, plus the interest.Families

or small businesses borrow when the interest rates are low, and most

often, are forced to pay back these loans when the rates are high. The

consequence is the absence of children and the collapse of the economy.In

some nations, the real rate of interest is 7% per month, which amounts

to 125% per year (shylocking), whereas the inflation rate is 9%. These

rates are usurious, and are the plain representation of greed. And there

are even worse systems.The

interest plays an even more pernicious role, when money is lent to

developing nations. In this case, these loans are granted with

advantageous rates, provided the creditor nations apply birth control

policies (like China’s one child policy, which brings about forced

abortions and the massacres of girls). This is the beginning of a

vicious circle, with debts causing the sacrifice of human persons to the

modern Moloch. Human rights and freedoms are crushed by the economic

system.Taxes and the social budgetNations

have borrowed from private banks huge sums of money which, for the most

part, is scriptural money created out of nothing. This money is based

on the wealth of the whole nation. This creation of money out of thin

air is legalized, but immoral, just like abortion which, even legalized,

remains a crime in the sight of God. These huge sums of borrowed money

bring about ever-increasing debt payments, which take an increasing part

of government budgets, leaving less money for health, education and

other services, creating unemployment, cuts, stress, quarrels, divorces,

downsizing, restructuration plans, etc.The

solution is obvious: the State must create its own money, interest

free. Savage capitalism eats up its own children, but so slowly that

some people actually get used to it.Interest and usury condemnedCardinal

Ratzinger recently said that there are over 40 million (declared)

abortions per year in the world. This means that if one counts the

abortions through coils and abortive pills (undeclared), for the last

ten years, there have been one billion human beings killed, not to

mention those who were not conceived because of the prevailing

contraception mentality. This slaughter is the worst of history. What

are the causes?In

the Old Testament, God and the Church have always condemned any

interest on the loan of money as usury, and not just high rates of

interest, especially through the teachings of St. Thomas Aquinas. (See

also Josue 3:15 and 4:18, Chronicles 12:15, Isaias 8:7 and 24:2, Daniel

8:16, Exodus 22;25, Nehemias 5:5, Leviticus 25:36, Psalms 15:5, Jeremias

15:10, Ezechiel 18:8, Proverbs, and in the New Testament, Matthew 25:27

and Luke 19:23.) In the Lord’s Prayer (the “Our Father”), which

Christians recite every day, the Latin version uses the words “debita

nostra” (reported in Matthew 6:12: “forgive us our debts”), which has

also to be understood in the literal sense, as taught by the Catechism

of the Catholic Church.There

is no difference between interest and usury, for it is the very

principle of charging interest on time that is pernicious. Besides, it

is obvious that the higher the interest, the more harmful it is. The

condemnations of greed by Pope Pius II are very harsh: “heretical

theories that are appaling and abominable.”The

penalty for this type of crime is the same as for all those who take

part in an abortion: excommunication. Popes Paul II, Sixtus IV, Innocent

VIII, Alexander VI, Julius II, and Leo XIII in Rerum Novarum also strongly condemned interest. ( an other form of voracious usury…)The encyclical Vix PervenitOn November 1, 1745, Pope Benedict XIV issued the encyclical letter Vix Pervenit,

addressed to the Bishops of Italy, about contracts, and in which usury,

or money-lending at interest, is clearly condemned. On July 29, 1836,

Pope Gregory XVI extended this encyclical to the whole Church. It says:“The

kind of sin called usury, which lies in the loan, consists in the fact

that someone, using as an excuse the loan itself — which by nature

requires one to give back only as much as one has received — demands to

receive more than is due to him, and consequently maintains that,

besides the capital, a profit is due to him, because of the loan itself.

It is for this reason that any profit of this kind that exceeds the

capital is illicit and usurious.“And

in order not to bring upon oneself this infamous note, it would be

useless to say that this profit is not excessive but moderate; that it

is not large, but small… For the object of the law of lending is

necessarily the equality between what is lent and what is given back…

Consequently, if someone receives more than he lent, he is bound in

commutative justice to restitution…”The interest in one of the factors that triggers inflation, and not the opposite. Pope John Paul II’s encyclical letter Veritatis Splendor reminds

us that there are intrinsic evils and absolute sins. To ignore them may

suppress personal sin (according to St. Thomas Aquinas, the borrower

commits no sin), but society pays for this misdeed, even at the cost of

its own disappearance, and those who favor the ignorance of the sin of

usury are responsible for endangering the survival of the population.What

comforts us, however, is that this condemnation of usury is repeated in

the new Catechism of the Catholic Church, at the end of the comments on

the Seventh Commandment.Impossible contracts are nullIt

is impossible to pay back interest-bearing loans, either they are

compound or not. Take the following example: Croesus borrows a principal

of 100 at the birth of Christ. If one applies an interest rate of 10%,

the sum to be paid back in the year 2000 is (100 x 1,12000), or six

times ten to the power of eighty-four, or a number with 84 zeros, which

simply blows the mind… It would represent 10 to the power of 68 houses

for every person on earth. It is obvious that it is impossible to

respect such a contract.A

French mathematician, M. Levy, showed that, after a while, all the

wealth in the world will be owned by the banks, through the simple

application of mathematical rules.Money

is a human creation which, if the interest is admitted, begets more

money. This money is not only a sign; it really causes deaths and

injuries, in every area. It is more prudent to forbid any new organism

that is self-reproducing (like viruses, the development of new species

in vitro, etc.), including abstract concepts like money that have

consequences in real life. The common good called “money” is in the

hands of people without scruples. It is a duty for society to take back

control over the issuance of money.It

is said that everything has a cost, and so the interest would be the

cost of money. However, money is not a thing, a commodity, but a sign, a

common good that belongs to all, just like water or air. It is

precisely the dream of the greedy to make people pay for the air and

water they consume. Money is a universal, and to leave its creation into

the hands of the supporters of death is a crime.Today,

money is more and more invested in labor-saving technology rather than

in creating jobs. The interest causes the repayment of loans to the

banks to go before the wages of workers, and to prefer to lay off these

workers instead of paying them. This is how human rights work today:

money, a sign or abstraction, comes before the human person, a reality.

Where is the dignity of the fathers of families, who are not bankers?

Besides, bankers do not have large families, for money comes even before

their own children.Abortion: a sacrifice to MolochThis

swindle of the “creation” of money by the banks, and the widespread use

of interest on the loan of money, favor economic crises and abortion

when loans have to be paid back. In Switzerland, the first reason given

by women who had an abortion is the repayment of loans, contracted by

themselves or their families. We know that there are other reasons

(hedonism, selfishness, fashions, social pressure, frivolity, ignorance,

etc.), but to shut up our eyes and do nothing against one of the causes

is neither scientific nor Christian. To let the people who earn money

without working (by collecting the interest on their loans) crush the

poor who are defenseless, is ridiculous. However, to defend the poor is

far from being ridiculous.History

of ancient Egypt shows the close link between mortgage rates and the

decline, even disappearance, of the population. (See the analysis of

Belgian historian Pirenne on the 20% rates that caused the deadly

exposition of children to the sun.)The

new Catechism of the Catholic Church maintains the condemnation of

interest and its harmful role at the end of the comments on the 7th

Commandment, which forbids to steal. As lay people, we must make this

condemnation understood by all, for it is a liberation for the poor;

moreover, an economy based on investment in real developments and

improvements (and not simply hoarding money through

the gimmick of the interest rates), is much more dynamic, and favors a

reduction of prices, while rewarding those who take risks in investing

in new developments.Justice

is necessary to achieve holiness. It is too easy to wash one’s hands of

the matter by saying that one understands nothing in economics.

Economics is not so complicated, especially when one takes the trouble

to humbly study solutions that are finally more practical than those who

manipulate public opinion want to make you believe.For

many centuries, the Church has been suffering, because her sons are

prisoners of a huge disinformation campaign. Maurice Allais, 1988 Nobel

Prize winner in Economics, wrote that the present international

financial system is the biggest disinformation system in human history.

The sons of darkness control this disinformation and crush the weak,

often with the help of the ignorant of good faith. Let us unmask them,

to give some fresh air amidst this general atmosphere of corruption.What to do?Why

not react now? The human race has survived for centuries without this

so-called creation of money at interest by banks, and even with no banks

at all. So, why not abandon these inhuman and outrageous interest rates

that know no limits and steal time from us as educators of our

children? The interest is time stolen from fathers and mothers.Nations

spend billions for research in physics. Let us spend a few million to

study more carefully the social doctrine of the Church and the practical

solutions it entails in favor of a sound economy. Let us create a

center of studies and formation for social action.Let

us make the promise made to Abraham possible. The earth is huge and

generous, as well as the seas. All the serious experts, after long

studies (cf. Julius Simon), admit that our planet can feed all the

population to come in the future. In fact, those who believe that the

earth is overpopulated neither believe in God nor in His promise. Let us

learn again to utter this greeting of the sons of Abraham: pax, peace,

shalom, salam… This peace, as Blessed Mother Teresa of Calcutta said,

will come on earth only if abortions are stopped, and if we accept those

who are different, the disabled.A salary for housewivesHousewives,

mothers who stay at home, work just as hard as those who are hired in

the workforce. They deserve a real salary, which will create more job

opportunities, boost consumption and the economy, and allow the Gross

National Product to double. It was possible to finance two world wars,

so there is no reason why it would not be possible to finance this wage

to housewives. In Canada, it is estimated that the work of housewives

represents 46% of the GNP. So it is simple justice, as Pope John Paul II

said, to reward them with a salary.Is is true that:The less the children in a family, the less vocations to sharing and generosity?The best school to teach the principle of subsidiarity is a large family?The main flaw in world politics is this generosity in the existence of intermediary bodies?The contraception mentality is directly aimed against large families?The system of interest directly attacks the family?The interest is a theft of time and children?The creation of money through interest is a lie and a swindle, a theft to the detriment of future generations (unborn children)?Can any person of good will take part in this slaughter, by action or omission? Can we stand up and stop this mechanism?Is

the teaching of St. Thomas Aquinas on usury still valid today? Can the

time that belongs to God be stolen? This is a good explanation for

stress.Any

human invention that has no limits is monstrous; the system of interest

rates has no limits. Moreover, a means of exchange, or unit of

measurement, cannot multiply by itself. If money breeds more money

today, it is at the expense of our own children. This is criminal!It

is easy to show that the present crisis is in large part due to this

search for zero population growth, based on flawed facts and analysis.

What a mistake it is to think that the earth cannot support all of the

present population, whereas Europe alone could feed many times the

world’s population, not to mention the resources of the oceans that are

barely developed.For

those who say: “We will have to change the way our deposits are managed

in banks,” I reply: “This is true, and you will be rewarded a

hundredfold, for a dynamic economy will benefit all, unless your

selfishness make you sad to see others happy. How sad it would be it you

were in such a situation, especially since you risk eternal damnation.All

this work is done with the hope that a few simple economic concepts can

be explained for the good of the poor, the unborn, especially in

Third-World countries. Don’t believe those who complicate everything to

keep their control over the economy, for billions of human beings will

never be born because of this control. True love cannot accept interest,

but it can accept just profit. Let us entrust the future of mankind to

the family, with mothers having for their model, Mary.François de Siebenthal