“There are hundreds of court cases where the IRS has sued citizens for tax evasion.

The late Eustace Mullins said that there was a 100 year charter for the

Federal Reserve. Mullins was an expert on the Federal Reserve. FED HAS

ENDED DECEMBER 2013.

Please, read carefully this law, the Pepper McFadden Bill in 1927… the FED is not included because it is not a bank from any state but

above the states in this case, even if in 12 states altogether, it is

not under State laws, then this law doe not apply to the FED and

they can not go against the common law forbidding perpetual agreement if

not made clear in writing and as defined very clearly…

… banks, used in this section, shall be held to include trust companies, savings

banks, or other such corporations or institutions carrying on the

banking business under the authority of State laws.”

limit, the Pepper McFadden Bill in 1927 is not valid in this case, the

definition of itself is clear, under the authority of State laws and the

FED is NOT covered by this definition, because it was voted by the

Congress ( even if I doubt the validity of this vote in the middle of

the night and with most voters sleeping or away, just before Christmas, at home…) Do they respect really the

bona fide in this case ???

The original Federal Reserve Act of 1913 did indeed provide for

expiration of the corporate “power” of the twelve Federal Reserve Banks

to exist in 20 years from the banks’ organization (not the adoption of

the Act).

Sec. 4 … the said Federal reserve bank shall become a body corporate

and as such … shall have power: … Second. To have succession for a

period of twenty years from its organization unless it is sooner

dissolved by an Act of Congress, or unless its franchise becomes

forfeited by some violation of law. Federal Reserve Act of 1913 (P.L.

63-43, 38 STAT. 251, 12 USC 221).

If you want to apply the State’s law, then in New-York ( see below…), the real seat of the biggest and “true” and strongest FED…It is by far the largest (by assets), most active (by volume) and most influential of the 12 regional Federal Reserve Banks.

According to the Pepper McFadden Bill in 1927, page 2, near the middle…

Quote:

law of the State under which such bank is incorporated.

The Uniform Statutory Rule Against Perpetuities

is not yet valid in New-York, it validates non-vested interests that would otherwise be void as

violating the common law rule if that interest actually vests within 90

years of its creation;[8]

it has been enacted in only 29 states (Alabama, Alaska, Arizona, Arkansas,

California, Colorado, Connecticut, Florida, Georgia, Hawaii, Indiana,

Kansas, Massachusetts, Minnesota, Montana, Nebraska, Nevada, New Jersey,

New Mexico, North Carolina, North Dakota, Oregon, South Carolina, South

Dakota, Tennessee, Utah, Virginia, Washington, West Virginia), the

District of Columbia, and the U.S. Virgin Islands, and is currently

under consideration in New York for 2013.[9]

We should fight against it urgently.

http://en.wikipedia.org/wiki/Rule_against_perpetuities

Sec. 2. (a) That section 5130 of the Revised Statutes of the

United States, subsection “ second n thereof as amended, be amended

to read as follows:

44 Second. To have succession from the date of the approval of

this Act, or from the date of its organization if organized after such

date of approval until such time as it be dissolved by the act o f its

shareholders owning two-thirds of its stock, or until its franchise

becomes forfeited by reason of violation of law, or until terminated

by either a general or a special Act of Congress or until its affairs

be placed in the hands of a receiver and finally wound up by him.”

(b) That section 5136 of the Revised Statutes o f the United

States, subsection “ seventh ” thereof, be further amended by adding

at the end of the first paragraph thereof the following:

“ Provided, That the business of buying and selling investment

securities shall hereafter be limited to buying and selling without…

END POINT AND IRS IS ILLEGAL, please see below

25 Fast Facts About The Federal Reserve – Please Share With Everyone You Know

As

As

we approach the 100 year anniversary of the creation of the Federal

Reserve, it is absolutely imperative that we get the American people to

understand that the Fed is at the very heart of our economic problems.

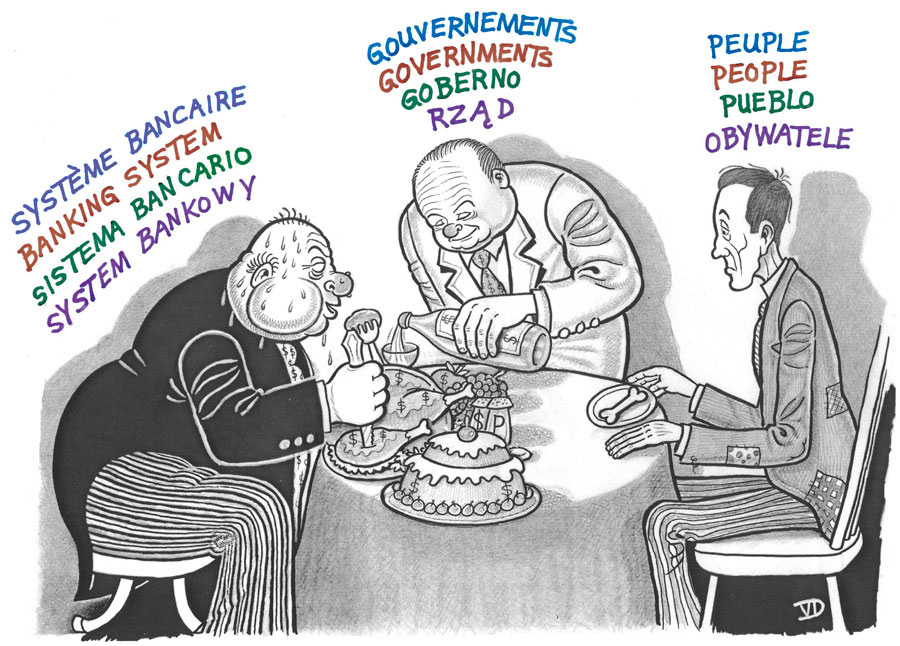

It is a system of money that was created by the bankers and that

operates for the benefit of the bankers. The American people like to

think that we have a “democratic system”, but there is nothing

“democratic” about the Federal Reserve. Unelected, unaccountable

central planners from a private central bank run our financial system

and manage our economy. There is a reason why financial markets respond

with a yawn when Barack Obama says something about the economy, but

they swing wildly whenever Federal Reserve Chairman Ben Bernanke opens

his mouth. The Federal Reserve has far more power over the U.S. economy

than anyone else does by a huge margin. The Fed is the biggest Ponzi scheme in the history of the world,

and if the American people truly understood how it really works, they

would be screaming for it to be abolished immediately. The following

are 25 fast facts about the Federal Reserve that everyone should know…

#1 The greatest period of economic growth in U.S. history was when there was no central bank.

#2 The United States never had a persistent, ongoing problem with inflation until the Federal Reserve was created.

In the century before the Federal Reserve was created, the average

annual rate of inflation was about half a percent. In the century since

the Federal Reserve was created, the average annual rate of inflation

has been about 3.5 percent, and it would be even higher than that if the inflation numbers were not being so grossly manipulated.

#3 Even using the official numbers, the value of the

U.S. dollar has declined by more than 95 percent since the Federal

Reserve was created nearly 100 years ago.

#4 The secret November 1910 gathering at Jekyll

Island, Georgia during which the plan for the Federal Reserve was

hatched was attended by U.S. Senator Nelson W. Aldrich, Assistant

Secretary of the Treasury Department A.P. Andrews and a whole host of

representatives from the upper crust of the Wall Street banking

establishment.

#5 In 1913, Congress was promised that if the Federal Reserve Act was passed that it would eliminate the business cycle.

#6 The following comes directly from the Fed’s official mission statement: “To

provide the nation with a safer, more flexible, and more stable

monetary and financial system. Over the years, its role in banking and

the economy has expanded.”

#7 It was not an accident that a permanent income tax was also introduced the same year

when the Federal Reserve system was established. The whole idea was to

transfer wealth from our pockets to the federal government and from the

federal government to the bankers.

#8 Within 20 years of the creation of the Federal Reserve, the U.S. economy was plunged into the Great Depression.

#9 If you can believe it, there have been 10 different economic recessions

since 1950. The Federal Reserve created the “dotcom bubble”, the

Federal Reserve created the “housing bubble” and now it has created the largest bond bubble in the history of the planet.

#10 According to an official government report, the Federal Reserve made 16.1 trillion dollars

in secret loans to the big banks during the last financial crisis. The

following is a list of loan recipients that was taken directly from page 131 of the report…

Citigroup – $2.513 trillion

Morgan Stanley – $2.041 trillion

Merrill Lynch – $1.949 trillion

Bank of America – $1.344 trillion

Barclays PLC – $868 billion

Bear Sterns – $853 billion

Goldman Sachs – $814 billion

Royal Bank of Scotland – $541 billion

JP Morgan Chase – $391 billion

Deutsche Bank – $354 billion

UBS – $287 billion

Credit Suisse – $262 billion

Lehman Brothers – $183 billion

Bank of Scotland – $181 billion

BNP Paribas – $175 billion

Wells Fargo – $159 billion

Dexia – $159 billion

Wachovia – $142 billion

Dresdner Bank – $135 billion

Societe Generale – $124 billion

“All Other Borrowers” – $2.639 trillion

#11 The Federal Reserve also paid those big banks $659.4 million in fees to help “administer” those secret loans.

#12 The Federal Reserve has created approximately 2.75 trillion dollars

out of thin air and injected it into the financial system over the past

five years. This has allowed the stock market to soar to unprecedented

heights, but it has also caused our financial system to become

extremely unstable.

#13 We were told that the purpose of quantitative

easing is to help “stimulate the economy”, but today the Federal Reserve

is actually paying the big banks not to lend out 1.8 trillion dollars in “excess reserves” that they have parked at the Fed.

#14 Quantitative easing overwhelming benefits those

that own stocks and other financial investments. In other words,

quantitative easing overwhelmingly favors the very wealthy. Even Barack Obama has admitted that 95 percent of the income gains since he has been president have gone to the top one percent of income earners.

#15 The gap between the top one percent and the rest of the country is now the greatest that it has been since the 1920s.

#16 The Federal Reserve has argued vehemently in federal court that it is “not an agency” of the federal government and therefore not subject to the Freedom of Information Act.

#17 The Federal Reserve openly admits that the 12 regional Federal Reserve banks are organized “much like private corporations“.

#18 The regional Federal Reserve banks issue shares of stock to the “member banks” that own them.

#19 The Federal Reserve system greatly favors the biggest banks. Back in 1970, the five largest U.S. banks held 17 percent of all U.S. banking industry assets. Today, the five largest U.S. banks hold 52 percent of all U.S. banking industry assets.

#20 The Federal Reserve is supposed to “regulate” the big banks, but it has done nothing to stop a 441 trillion dollar interest rate derivatives bubble from inflating which could absolutely devastate our entire financial system.

#21 The Federal Reserve was designed to be a perpetual debt machine.

The bankers that designed it intended to trap the U.S. government in a

perpetual debt spiral from which it could never possibly escape. Since

the Federal Reserve was established nearly 100 years ago, the U.S.

national debt has gotten more than 5000 times larger.

#22 The U.S. government will spend more than 400 billion dollars just on interest on the national debt this year.

#23 If the average rate of interest on U.S.

government debt rises to just 6 percent (and it has been much higher

than that in the past), we will be paying out more than a trillion

dollars a year just in interest on the national debt.

#24 According to Article I, Section 8 of the U.S. Constitution,

the U.S. Congress is the one that is supposed to have the authority to

“coin Money, regulate the Value thereof, and of foreign Coin, and fix

the Standard of Weights and Measures”. So exactly why is the Federal

Reserve doing it?

#25 There are plenty of possible alternative financial systems, but at this point all 187 nations that belong to the IMF have a central bank. Are we supposed to believe that this is just some sort of a bizarre coincidence?

More at:

http://desiebenthal.blogspot.ch/2013/10/fed-has-ended-end-of-2012-mayan.html

IRS, the Internal Revenue Service, is illegal.

“There are hundreds of court cases where the IRS has sued citizens for tax evasion.

http://www.youtube.com/watch?v=YGAaPjqdbgQ

http://www.youtube.com/watch?v=N331kGvh0U0

http://www.youtube.com/watch?v=YGAaPjqdbgQ

http://freedomtofascism.com

The Federal Mafia exposes every facet of the government’s illegal

enforcement of the income tax – and will convince you that Organized

Crime in America begins with The Federal Government – which is why the

federal government has enjoined me from selling the book, so now I’m

posting it for FREE!

http://www.paynoincometax.com/

…..

The government doesn’t

want you to know what’s in this book, so now you can download it for

FREE! Just right click the button below, to save it on your computer.

Please share it with everyone you know who will read it.

http://video.google.com/videop…..8446177859 …. Irwin Schiff’s Secrets of Living an Income Tax-Free Life – 1:57:40 – Nov 16, 2006

http://video.google.com/videop…..2700134771 …. Irwin Schiff speaks out on the war – 52:14 – Jun 9, 2006

http://www.believe.com.au/Who%20or%20What%20Influences%20your%20Mind.swf

(518) 656-3578 ; Bob Schulz, the chairman of the Foundation that ran the ad.]

(518) 656-3578 ; Bob Schulz, the chairman of the Foundation that ran the ad.]

These are the major points expressed in a Remonstrance, that was hand

delivered to leaders of the three branches of the federal government

on April 13, 2000, by a group of citizen-delegates representing all 50

states. These grievances concern alleged illegal operations of the federal income tax system and the IRS.

Remonstrance was signed by thousands of citizens, and was delivered as

part of an event sponsored by We The People Foundation for

Constitutional Education, a not-for-profit corporation dedicated to research and education in matters of taxation & governance.

The 16th amendment to the U.S. Constitution (the “income tax

amendment”) was fraudulently and illegally proclaimed to be ratified in

1913. Exhaustive legal research from both state and national archives

documented conclusively that the amendment did not even come close to

being legally approved by the required number of states. The Courts

have refused to hear this issue.

Stahl’s claim that ratification of the 16th Amendment was fraudulently

certified constitutes a political question , because we could not

undertake independent resolution of this issue without expressing lack

of respect due coordinate branches of government?.” — U.S. v Stahl (1986), 792 F2d 1438

Citizens cannot “voluntarily” file a federal income tax return without

surrendering their 5th amendment right not to bear witness against

themselves. You can be criminally prosecuted for your “voluntary” return.

Schulz, chairman of the Foundation, and Joseph Banister, a former

special agent of the Criminal Investigation Division of the IRS (accompanied by a videographer) delivered copies of the Remonstrance to designated officials of the three branches.

the White House and the Capitol, the delegates had the opportunity to

explain and discuss the contents of the Remonstrance, and to ask that

the government send experts representing the three branches to a

conference to be held in June, where those experts could debate the tax

issues with a group of researchers invited by the Foundation.

officials the delegates delivered the Remonstrance to were: At the

White House-Jason Furman, Senior Director and Senior Economic Advisor

of the National Economic Council; at the Capitol-Dr. William Koetzle,

Legislative Director for Speaker Hastert, and Keith Hennessey, Policy

Director for Senate Majority Leader Lotte.

on June 2nd the White House reneged on the promises it made during the

April 13th meeting. As with three previous conferences, the government

has again refused to debate the grievances. Jason Furman told Robert

Schulz, “The legality of the income tax is not a high priority item at

the White House, and we will not participate in any conference on the

subject.”

the government had valid counter-arguments to the Remonstrance, it

should be a simple matter to clarify the law, provide the appropriate

regulatory references and promptly settle the matter. Our government’s repeated avoidance of these debates should speak volumes.

this, the 224th birth celebration of our one Nation under God, the We

The People Foundation offers the following facts, internet links and a

challenge for each American: Read the facts for yourself. Judge what is

truth. Pass it on.

hope you will join many who now believe that the time has come for our

government and our nation to begin a long-overdue process of public

debates concerning the economic, political and constitutional problems

posed by the true legal restrictions upon our current system of

taxation.

a nation of justice and due process, we cannot tolerate a tax system,

or a government, that seizes our property, sends us to prison and

induces fear in our hearts — while refusing to provide us basic proof

of their legal authority, clearly written tax codes and unambiguous

legal rulings on Constitutional and legal issues concerning the income

tax.

pray that you be convinced that nothing less than our freedoms, our

property and our Republic are at stake. The Soul of America needs

illumination. Please join us.

issue of the fraudulent ratification of the 16th amendment has never

been decided by a court of law. The courts have instead tossed the issue

into the lap of Congress as a “political question,” even though fraud

is a clear issue for judicial review, not a political question.

brief report printed by the Congressional Research Service in 1985

states up front that, “The report does not attempt to rebut specific

factual allegations?.” It then goes on to make the astonishing assertion

that the actions of a government official must be presumed to be

correct and cannot be judged or overturned by the courts! (John Ripy, “Ratification of the Sixteenth Amendment.” CRS, 1985.)

attorney speaking for Senator Orin Hatch in 1984 offered to pay former

tax investigator William Benson a fortune not to publish his research

proving that the 16th amendment did not even come close to being

legally ratified by the required number of states in 1913.

Knox, Secretary of State from 1909 to 1913 during the Taft

administration, proclaimed the 16th amendment to be ratified just a few

days before he left office in 1913, to make way for the Wilson

administration, even though he knew it had not been legally ratified. Philander

Knox had for many years been the primary attorney for the richest men

in America, including Carnegie, Rockefeller, Morgan and the

Vanderbilts. He had created for them the largest cartel in the world,

then was appointed, at their request, as Attorney General in the

McKinley/Roosevelt administrations, where he refused to enforce the

Sherman anti-trust laws against the cartel he had just created.

income tax amendment was pushed through Congress in 1909 by Sen.

Nelson Aldrich, father-in-law of John D. Rockefeller, Jr. and

grandfather and namesake of Nelson A. Rockefeller, and would not have

been ratified if Knox had not fraudulently proclaimed it so.

Kentucky’s legislature rejected the amendment, but Knox counted

Kentucky as having approved it. Example: Oklahoma’s legislature changed

the amendment’s wording so that it meant just the opposite of what was

submitted to the states by Congress, but Knox counted Oklahoma as

approving the amendment. Minnesota did not submit any results or copy of

their vote to Knox, yet he counted Minnesota as approving the

amendment.

scholars have agreed that if any state violated provisions of its own

state constitution in the ratification process, its approval would be

null and void. At least 20 states were guilty of serious violations of

their constitutions. For example, Tennessee’s constitution provided that

the state legislature could not act upon any proposed amendment to the

U.S. Constitution submitted by Congress until after the next state

legislative elections. Yet the Tennessee legislature acted on the

proposed 16th amendment the same month it was received and before any

elections.

have been extraordinarily unwilling to allow defendants in “failure to

file” cases to present evidence or testimony of expert researchers

regarding the constitutionality of the 16th amendment.

have been acquitting defendants in failure-to-file income tax return

cases due to lack of demonstrable evidence that there is any law or

regulation that requires it.

increasing number of employers have stopped withholding taxes from

their workers, and stopped filing W-2s and 1099s for the same reason.

one is a foreigner working in the U.S., or a U.S. citizen earning

money abroad, one is not liable for the federal income tax.

OMB Number on Form 1040 is cross-referenced in the Code of Federal

Regulations to the section covering taxes by resident aliens, which,

therefore, doesn’t apply to most Americans.

to an inquiry by a constituent who was a tax consultant, Sen. Daniel

Inouye told him that based on research performed by the Congressional

Research Service, no provision of the Internal Revenue Code requires an

individual to pay income taxes. He then went on to warn that Section

7201 sets forth numerous penalties for not paying income taxes owed.

However —

failure-to-file law applies to alcohol-tobacco-firearms taxes,

(Section 7201), not to income taxes, and convictions are based on the

mis-application of the alcohol-tobacco- firearm regulations.

law requires employees to provide a Social Security Number to an

employer, nor for an employer to demand one from an employee.

10th Circuit Court of Appeals has ruled that the filing of an income

tax return (Form 1040) and the information on the 1040 is not

compelled, and, therefore, the principle that no one may be forced to

waive their 5th amendment rights in order to comply with a law is not

applicable to federal income tax returns.

[5th Amendment] privilege protects against compelled testimonial

communications?.” U.S. v Conklin (1994), WL 504211 (10th Cir. Colo.)

Benson’s detailed legal research exposing the FRAUDULENT RATIFICATION

of the 16th Amendment. * Buy his 2-volume report!

agent quits, in 1999, because the IRS refused to rebut his research

showing the illegal status of the income tax system *Free viewing of

report.

research on tax, constitutional issues. {The website is now under

federal court injunction, which they proudly display! — see below.}

1-800-794-1791

1-800-794-1791

Schiff’s site. Author & Lecturer on income taxes. {Their federal

court order was suspended! Is this a great country or what?}

ADVERTISEMENT IS OUR “CALL TO ACTION.” IF WHAT YOU HAVE JUST READ MADE

YOU ANGRY (WITH THEM OR WITH US), OR IF YOU JUST WANT TO KNOW MORE,

CONTACT US. WE’LL SEE THAT YOU ARE UPDATED REGULARLY ON THIS IMPORTANT

ISSUE. GO TO <www.givemeliberty.org> AND CLICK ON ” UPDATE ME ON INCOME TAX ISSUE.” THOMAS JEFFERSON SAID IT BEST: “WHEN

THE GOVERNMENT FEARS THE PEOPLE, YOU HAVE LIBERTY. WHEN THE PEOPLE

FEAR THE GOVERNMENT, YOU HAVE TYRANNY.” Sponsored by the “We The People

Foundation for Constitutional Education, Inc.” www.givemeliberty.org ;

http://www.youtube.com/watch?v=x-CrNlilZho

For

the New World Order, a world government is just the beginning. Once in

place they can engage their plan to exterminate 80% of the world’s

population, while enabling the “elites” to live forever with the aid of

advanced technology. For the first time, crusading filmmaker ALEX JONES

reveals their secret plan for humanity’s extermination: Operation

ENDGAME.

Jones chronicles the history of the global elite’s

bloody rise to power and reveals how they have funded dictators and

financed the bloodiest wars—creating order out of chaos to pave the way

for the first true world empire. * Watch as Jones and his team track

the elusive Bilderberg Group to Ottawa and Istanbul to document their

secret summits, allowing you to witness global kingpins setting the

world’s agenda and instigating World War III. * Learn about the

formation of the North America transportation control grid, which will

end U.S. sovereignty forever. * Discover how the practitioners of

the pseudo-science eugenics have taken control of governments worldwide

as a means to carry out depopulation. * View the progress of the

coming collapse of the United States and the formation of the North

American Union.

FED ? the Pepper McFadden Bill in 1927

[Public—No. 639—69th Congress]

[H. R. 2]

An Aot To further amend the national banking laws and tfce

Federal Reserve Aot, and for other purposes.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled} That the Act

entitled “An Act to provide for the consolidation of national

banking associations,” approved November 7, 1918, be amended by

adding at the end thereof a new section to read as follows:

“ Sec. 3. That any bank incorporated under the laws of any State,

or any bank incorporated in the District of Columbia, may be

consolidated with a national banking association located in the

same county, city, town, or village under the charter of such

national banking association on such terms and conditions as may

be lawfully agreed upon by a majority of the board of directors of

each association or bank proposing to consolidate, and which agree*

ment shall be ratified and confirmed by the affirmative vote oi the

shareholders of each such association or bank owning at least two*

thirds of its capital stock outstanding, or by a greater proportion

of such capital stock in the case of such State bank if the laws of

the State where the same is organized so require, at a meeting to

be held on the call of the’directors after publishing notice of the

time, place, and object of the meeting for four consecutive weeks

in some newspaper of general circulation published in the place

where the said association or bank is situated, and in the legal*

newspaper for the publication of legal notions or advertisements,

i f any such paper has been designated by the rules of a court in

the county where such association or bank is situated, and if no

newspaper is published in the place, then in a paper of general

circulation published nearest thereto, unless such notice of meeting

is waived in writing by all stockholders of any such association

or bank, and after sending such notice to each shareholder of-record

by registered mail at least ten days prior to said meeting, but any1

additional notice shall be given to the shareholders of such State

bank which may be required by the laws of the State where the

same is organized. The capital stock of such consolidated association

shall not be less than that required under existing law for the

organization of a national banking association in the place in which

such consolidated association is located; and all the rights, franchises,

and interests of such State or District bank so consolidated.. with a

national banking association in and to every species of property,

real, personal, and mixed, and choses in action thereto belonging,

shall De deemed to be transferred to and vested in such national

banking association into which it is consolidated without any deed

or other transfer, and the said consolidated national banking association

shall hold and enjoy the same and all rights of property,

franchises, and interests including the right of succession as trustee,

executor, or in any other fiduciary capacity in the same manner ana

to the same extent as was held and enjoyed by such State or District

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

2 [P u b . f>39.)

bank so consolidated with such national banking association. When

such consolidation shall have been effected and approved by the comptroller

any shareholder of either the association or of the State or

District bank so consolidated, who has not voted for such consolidation,

may give notice to the directors of the consolidated association

within twenty days from the date o f the certificate of approval of the

comptroller that he dissents from the plan of consolidation as

adopted and approved, whereupon he shall be entitled to reeeive the

value of the shares so held by him, to be ascertained by an appraisal

mode by a committee o f three persons, one to be selected by the

shareholder, one by the directors o f the consolidated association, and

the third by the two so chosen; and in case the valuejso fixed shall

Currency, who cauge a reappraisal to be made, which shall be

final and binding; and the consolidated association shall pay the

expenses o f reappraisal, and the value as ascertained by such

appraisal or reappraisal shall be deemed to be a debt due and shall

be forthwith paia to said shareholder by said consolidated association,

and the shares so paid for shall be surrendered and, after due

ftotice; sold at public auction within thirty days after the final

appraisement provided for in this Act; and i f the shares so sold at

public auction shall be sold at a price greater than the final

appraised value, the excess in such sale price shall be paid to the

said shareholder; and the consolidated association shall have the

right to purchase puch shares at public auction, i f it is the highest

bidder therefor, for the purpose of reselling such shares within

thirty days thereafter to such person or persons and at such price

as it« board of directors by resolution may determine. The liquidation

of such shares of stock in any State bank shall be determined

in the manner prescribed by the law of the State in such cases i f

such provision is made in the State law; otherwise as hereinbefore f>rovided. No such consolidation shall be in contravention of the

aw of the State under which such bank is incorporated.

u The Avoi ds 4 State bank,’ 4 State banks,’ 4 bank/ or 4 banks,’ a$

used in this section, shall be held to include trust companies, savings

banks, or other such corporations or institutions carrying on tho

banking business under the authority of State laws.”

Sec. 2. (a) That section 5130 of the Revised Statutes of th$

United States, subsection “ second n thereof as amended, be amended

to read as follows:

44 Second. To have succession from the date of the approval of

this Act, or from the date of its organization if organized after such

date of approval until such time as it be dissolved by the act o f its

shareholders owning two-thirds of its stock, or until its franchise

becomes forfeited by reason of violation of law, or until terminated

by either a general or a special Act of Congress or until its affairs

be placed in the hands of a receiver and finally wound up by him.”

(b) That section 5136 of the Revised Statutes o f the United

States, subsection “ seventh ” thereof, be further amended by adding

at the end of the first paragraph thereof the following:

“ Provided, That the business of buying and selling investment

securities shall hereafter be limited to buying and selling without

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

recourse marketable obligations evidencing indebtedness of any

person, copartnership, association, or corporation, in the form of

bonds, notes and/or debentures, commonly known as investment

securities, under such further definition of the term ‘ investment

securities ’ as may bv regulation be prescribed by the Comptroller

of the Currency, ana the total amount of such investment securities

of any one obligor or maker held by such association shall at no

time exceed 25 per centum of the amount of the capital stock of such

association actually paid in and unimpaired and 25 per centum of

its unimpaired surplus fund, but this limitation as to total amount

shall not apply to obligations of the United States, or general

obligations or any State or of any political subdivision thereof, or

obligations issued under authority of the Federal Farm Loan Act:

And provided further, That in carrying on the business commonly

known as the safe-deposit business no such association shall invest

in the capital stock o f a corporation organized under the law of jtny

State to conduct a safe-deposit business in an amount in excess of

15 per centiim of the capital stock of such association actually paid

in and unimpaired and 15 per centum of its unimpaired surplus,99

so that the subsection as amended shall read as follows:

“ Seventh. To exercise by its board of directors, or duly authorized

officers or agents, subject to law, all such incidental powers as shall

be necessary to carry on the .business of banking; oy discounting

and negotiating promissory notes, drafts, bills of exchange, and

other evidences *f debt; by receiving deposits; by buying and

selling exchange, ooin, and bullion; by loaning money on personal

security; and by obtaining, issuing, and circulating notes according

to the provisions of this title: Prmnded, That the business of buying

and selling investment securities shall hereafter be limited to buying

and selling without recourse marketable obligations evidencing

indebtedness of any person, copartnership, association, or corporation,

in the form at bonds, notes and/or debentures, commonly

known as investment securities, under such fifrther definition of the

term 4 investment securities ’ as may by regulation be prescribed by

the Comptroller of the Currency, and the total amount of sucn

investment securities of any one obligor or maker held by such

association shall at no time exceed 25 per centum of the amount of

the capital stock of such association actually paid in and unimpaired

and 25 per centum of its unimpaired surplus fund, but this limitation

as to total amount shall not apply to obligations of the United

States, or general obligations of any State or of any political

subdivision thereof, or obligations issued under authority of the

Federal Farm Loan Act: And provided further, That in carrying

on the business commonly known as the safe deposit business no

such association shall invest in the capital stock of a corporation

organized under the law of any State to conduct a safe deposit

business in an amount in excess of 15 per centum of the capital

stock of such association actually paid in and unimpaired and 15

per centum of its unimpaired surplus.

“ But no association shall transact any business except such as is

incidental and necessarily preliminary to its organization, until it

has been authorized by the Comptroller of the Currency to commence

the business of banking.”

(Pub. « t j 8

20366 O— 58—— 2-6

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

S ec, 3. That section 0187 of the Revised Statute* o l the United

Staten, subsection “ First ” thereof, be amended to rettd as follows:

“ First Such m shall b« necessary for its accommodation in the

transaction of its business.”

Sbo. 4. That section 5188 o f tho Revised Statutes o f the ITnited

States, as amended, be amended to read as follows:

“ Skc. 5138. No national banking association shall be organized

with a less capital than $100,000, except that such associations with

a capital of not less than $50,000 may, with the approval of the

Secretary of the Treasury, be organized in any place Che population

of which does not excced six thousand inhabitants, aikf except

that such associations with a capital of not less than $25,000 may,

with die sanction of the Secretary of tile Treasury, be organized fn

any plaoe the population of which does not exceed three thousand

inhabitants. No such association shall be organized in a city the

population of which exceeds fifty thousand persons with a capital

of less than $200,000, except that in the outlying districts of such a

city where the State laws permit the organization of State banks

with a capital of $100,000 or less, national banking associations now

organized or hereafter organized may, with the approval of the

Comptroller of the Currency, have a capital of not less than

$100,000.”

See. 5. That section 6142 of the Revised Statutes of the United

States, as amended, be amended to read as follows:

“ Sec. 5142. Any national banking association may, with the

approval of the Comptroller of the Currency, and by a vote of

shareholders owning two-thirds o f the stock of such associations,

increase its capital stock to any sutn approved by the said comptroller,

but no increase in capital shall be valid until the whole

amount of such increase is paid in and notice thereof, duly acknowledged

before a notary public by the president, vioe president, or

cashier of said association, has been transmitted to the Comptroller

of the Currency and his certificate obtained specifying the amount

of such increase in capital stock and his approval thereof, and

that it has been duly paid in as part of the capital of such association:

Provided, hon-cner, That a national banking association mav, with

the approval of the Comptroller of the Currency, and by me vote

of shareholders owning two-thirds of the stock of such association,

increase its capital stock by the declaration of a stock dividend,

provided tlmt the surplus of said lysociation, after the approval of

the increase, i-hall be at least equal to 20 per centum of the capital

stock as increased. Such increase shall not be effective until a

certificate certifying to such declaration of dividend, signed by the

president, vice president, or cashier of said association and duly

acknowledged before a notary public, shall have been forwarded

to the Comptroller of the Currency and his certificate obtaihed specifying

the amount of such increase of capital stock by stock dividend,

and his approval thereof.”

Sr.o. 6. That section 5150 of the Revised Statutes of the United

States be amended to read as follows:

“ Sec. 5150. The president of the bank shall be a member of the

board and shall be the chairman thereof, but the board may designate

4 (Mfe.Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

a director in lieu of the president to be chairman of the board,

who shall perform such duties as may be designated by the board.”

Seo. 7. That section 5155 of the Kevised Statutes of the United

States be amended to read as follows:

“ S ec, 5155. The conditions upon which a national banking association

may retain or establish and operate a branch or branches are

the following:

“ (a) A national banking association may retain and operate

such branch or branches as it may have in lawful operation at the

date of the approval of this Act, and any national banking association

which has continuously maintained and operated not more than

one branch for a period of more than twenty-five years immediately

preceding the approval of this Act may continue to maintain and

operate such branch.

“ (b) I f a State bank is hereafter converted into or consolidated

with a national banking association, or if two or more national banking

associations are consolidated, such converted or consolidated

association may, with respect to any of such banks, retain and operate

any of their branches which may have been in lawful operation

by any bank at the date of the approval of the Act.

“ (c) A national banking association may, after the date of the

approval of this Act, establish and operate new brandies within the

limits of the city, town, or village in which said association is situated

if such establishment and operation are at the time permitted to

State banks by the law of the State in question.

“ (d) No branch shall be established after the date of the approval

of tnis Act within the limits of any city, town, or village of which

the population by the last decennial census was less than twenty-five

thousand. No more than one such branch may be thus established

where the’population, so determined, of such municipal unit does not

exceed fifty thousand.; and not more than two such branches where

the population does not exceed one hundred thousand. In any such

municipal unit where the population exceeds one hundred thousand

the determination of the number of branches shall be within the

discretion of the Comptroller of the Currency.

“ (e) No branch ot any national banking association shall be

established or moved from one location to another without first

obtaining the consent and approval of the Comptroller of the

Currency.

“ ( f) The term ‘ branch’ as used in this section shall be held to

include any branch bank, branch office, branch agency, additional

office, or any branch place of business located in any State or Territory

of the United States or in the District of Columbia at which

deposits are received, or checks paid, or money lent.

“ (g) This section shall not be construed to amend or repeal section

25 of the Federal Reserve Act, as amended, authorizing the

establishment by national banking associations of branches in foreign

countries, or dependencies, or insular possessions of the United

Stilt es.

“ (h) The words ‘ State bank,’ ‘ State banks,’ ‘ bank,’ or ‘ banks,’

as used in this section, shall be held to include trust companies,

savings banks, or other such corporations or institutions carrying

on the banking business under the authority of State laws.”

[Ptm. 6M.! 5

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

Sm & TJv»t section 5190 of the Reyised Statute* ot tb» United

States be amended to read m follows:

“ S e c . 6190. The general business of each national banking

association shall be transacted in the place specified in its

organisation certificate and in the brunch or branches, i l any.

established or maintained by it in accordance with the provision* o f

section 5155 of the Revised Statutes, as amended by this Act.”

Sec. 9, That the first paragraph of action 9 of the Federal

Reserve Act, as amended, be amended sp tut to read as follows:

“ Sec. 9. Any hank incorporated by special law o i any State, or

organized under the general laws of any State or of the United

States, desiring to become a member o f th» Federal reserve system,

may make application to the Federal Reserve Board, under such

rules and regulations as it may prescribe, for th» right to subscribe

to the stock of the Federal reserve bank organized within the district

in which the applying’ bank is located, Such application shall be

for the same amount of stock that the applying bank would be

required to subscribe to as a national bank. The. Federal Reserve

Roard* subject to the provisions of this Act and to such conditions

as it may prescribe pursuant thereto niuy permit the applying bank

to become a stockholder of such Federal reserve bank.

“ Any such State bank which, at the date of the approval of this

Act, has established and is operating a branch or branches in

conformity with the State law, may retain and- operate the same

while remaining, or upon becoming a stockholder of such Federal

reserve bank; but no such State bank may retain or acquire stock

in a Federal reserve bank except upon relinquishment of any branch

or branches established after the date of the approval of this Act

beyond the limits of the city, town, or village in which the parent

bank is situated,”

Sec. 10, That section 5200 of the Revised Statutes of the United

States, as amended, be amended to read a? follows:

u Sec, 5200. The total obligations to any national banking association

of any person, copartnership, association, or corporation shall

at no time exceed 10 per centum o f the amount of the capital stock

of such association actually paid in and unimpaired and 10 per

centum of its unimpaired surplus fund. The tem ‘ obligations ’

shall mean the direct liability of the maker or acceptor of paper

discounted with or sold to such association and the liability of the

indorser, drawer, or guarantor who obtains a loan from or discounts

paper with or sells paper under tiis guaranty to such association

and shall include in the case o f obligations of a copartnership or

association the obligations of the several members thereof. Sueh

limitation of 10 per centum shall be subject to the following

exceptions:

“ (1) Obligations in the form of drafts or bills of exchange

drawn in good faith against actually existing values shall not be

subject under this section to any limitation based upon such capital

and surplus.

“ (2) Obligations arising out o f the discount o f commercial or

business paper actually owned by the person, copartnership, association,

or corporation negotiating the same shall not be subject under

this section to any limitation based upon such capital and surplus.

6 Gftw-JMJ

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

IPmlMJ 7

“ (8) Obligations drawn in good faith against actually existing

value* and secured by goods or commodities in process o f shipment

shall not be subject under tliia section to any limitation based upon

•uch capital and surplus.

“ (4) Obligations as indorwr or guarantor of notes, other than

commercial or business paper excepted under (2) hereof, having a

maturity of not more than six months, and owned by the person,

Corporation, association, or copartnership indorsing and negotiating

the same, shall be subject under this section to a limitation of 15

per centum of such capital and surplus in addition to such 10 per

centum of such capital and surplus.

“ (5) Obligations in the form of banker’s acceptances of other

banks of the kind described in section 18 of the Federal Reserve

Act, shall not be subject under this section to any limitation based

upon such capital and surplus*

“ (6) Obligations o f any person, copartnership, association or

corporation, in the form of notes or drafts secured by shipping

documents, warehouse receipts or other such documents transferring

pr securing title covering readily marketable nonpenshable staples

when such property is fully covered by insurance, i f it is customary

to insure such staples, shall be subject under this seetion to a limitation

o f 15 per centum of such capital and surplus in addition to

such 10 per centum of such capital and surplus when the market

value of such staples securing such obligation is not at any time less

than 115 per centum of the face amount of such obligation, and to an

additional increase o f limitation of 5 per centum of such capital and

surplus in addition to such 25 per centum of such capital and surplus

when the market value of such staples securing such additional

obligation is not at any time less than 120 per centum of the face

amount of such additional obligation, and to a further additional

increase of limitation of 5 per centum of such capital and surplus

in addition to such 30 per centum of such capital and surplus

when the market value of such staples securing such additional

obligation is not at any time less than 125 per centum of the face

amount of such additional obligation, and to a further additional

increase of limitation of 5 per centum of such capital and surplus

in addition to such 35 per centum of such capital and surplus when

the market value o f such staples securing sucn additional obligation

is not at any time less than 130 per centum of the face amount of such

additional obligation, and to a further additional increase of limitation

of 5 per centum of such capital and surplus in addition to such

40 per centum of such capital and surplus when the market value

of such staples securing such additional, obligation is not at any

time less than 135 per centum of the face amount of such additional

obligation, and to a further additional increase of limitation of

5 per centum of such capital and surplus in addition to such 45

per centum of such capital and surplus when the market value of

such staples securing such additional obligation not at any time

less than 140 per centum of the face amount of such additional

obligation, but this exception shall not apply to obligations of any

one person* copartnership, association or corporation arising from

the same transactions and/or secured upon the identical staples for

more than ten months.

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

8

“ (7) Obligations of any person, copartnership, association, or

corporation in the forip of notes or drafts secured bv shipping

documents or instruments transferring or securing title covering

livestock or giving a lien on livestock when the market value ox

the livestock securing the obligation is not at any time less than

115 per centum of the face amount of the notes covered by such

documents shall be subject under this section to a limitation of

15 per centum of such capital and surplus in addition to such 10

per centum of such capital and surplus.

“ (8) Obligations of any person, copartnership, association, ^ or

corporation m the form of notes secured by not less than a like

amount of bonds or notes of the United States issued since April

24, 1917, or certificates of indebtedness of the United States, snail

(except to the extent permitted by rules and regulations prescribed

by the Comptroller of the Currency, with the approval of the

Secretary or the Treasury) be subject under this section to a

limitation of 15 per centujpi of such capital and surplus in addition

to such 10 per centum of such capital and surplus.”

S ec. 11. That section 5202 of the Revised Statutes of the United

States as amended be amended by adding at the end thereof a new

paragraph to read as follows:

“ Eighth. Liabilities incurred under the provisions of section 202

of Title II of the Federal Farm Loan Act, approved July 17, 1916,

as amended by the Agricultural Credits Act or 1923.”

Seo. 12. That section 5208 of the Revised Statutes of the United

States as amended be amended by striking out the words “ or who

shall certify a check before the amount thereof shall have been

regularly entered to the credit of the drawer upon the books of the

bank,” and in lieu thereof inserting the following: “ or who shall

certify a check before the amount thereof shall have been regularly

deposited in the bank by the drawer thereof,” so that the section

as amended shall read as follows:

“ S eo. 5208. It shall be unlawful for any officer, director, agent,

or employee of any Federal reserve bank, or any member bans as

defined in the Act. of December 23, 1913, known as the Federal

Reserve Act, to certify any check drawn upon such Federal reserve

bank or member bank unless the person, firm, or corporation drawing

the (‘heck has on deposit with such Federal reserve bank or member

bank, at the time such check is certified, an amount of money not

less than the amount specified in such check. Any check so

certified by a duly authorized officer, director, agent, or employee

shall be a good and valid obligation against such Federal reserve

bank or member bank; but the act of any officer, director, agent, or

employee of any such Federal reserve bank or member bank in

violation of this section shall, in the discretion of the Federal

Reserve Board, subject such Federal reserve bank to the penalties

imposed by section 11, subsection (h) of the Federal Reserve Act,

and shall subject such member bank, if a national bank, to

the liabilities and proceedings on the part of the Comptroller of

the Currency provided for in section 5234, Revised Statutes,

and shall, in the discretion of the Federal Reserve Board, subject

any other member bank to the penalties imposed by section 9

ol* said Federal Reserve Aet for the violation of any of the provi-

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

•tow of rtrfd Act. Any ofllcor, director, agent, or employee of any

SeAw*! reserve bank or member tank who snail willfully violate

lb* provisions of this weetion, or who shfltll resort to any device,

or’*eeelv« any fictitious obligation, directly or collaterally, in order

to •vide the provMons thereof, or who shall certify a check

%e#ord the amount thereof ahall have been regularly deposited in tho

bank by the drawer thereof, shall be deemed guilty of a misdemeanor

and ctMli, on conviction thereof in any district court of the United

States, be fined not more than $5,00(), or shall be imprisoned for not

more than five years, or both, in the discretion of tne court.”

Sw. 18. That section 5211 of the Revised Statutes of the United

IStfttea as amended be amended to read as follows:

*8»c. 5211. Every association shall make to the Comptroller of

the Currency not leas than three reports during each year, according

to the form which may be prescribed by him, verified by the oath or

affirmation of the president, or of the cashier, or of a vice president,

Or of an assistant cashier o f the association designated by its board

of directors to verify such reports in the absence of the president

and cashier, taken before a notary public properly authorised find

■commissioned by the State in which such notary resides and tho

association is located, or any other officer having an official seal,

anthomed in such State to administer oaths, ana attested by the

signature of at least three of the directors. Each such report shall

exhibit, in detail and under appropriate heads, the resources and

liabilities of the association at the close of business on any past day

by him specified, and shall be transmitted to the comptroller within

five days after the receipt of a request or requisition therefor from

him; and the statement of resources and liabilities, together with

acknowledgment and attestation in the same form in which it is

made to the comptroller, shall be published in a newspaper published

in the place where such association is established, or if there is rio

newspaper in the place, then in the one published nearest thereto in

the same county* at the expense of the association; and such proof

o f publication shall be furnished as may be required by the comptroller.

The comptroller shall also have power to calf for special

reports from any particular association whenever in his judgment

th® same are necessary in order to obtain a full and complete

knowledge of its condition.”

Sec. 15. That section 22 of the Federal Reserve Act, subsection

(a), paragraph 2 thereof, be amended to read as follows:

“ (a) No member bank and no officer, director, or employee thereof

shall hereafter make any loan or grant any gratuity to any bank

examiner. Any bank officer, director, or employee violating this

provision dhall lie deemed guilty of a misdemeanor and shall bo

imprisoned not exceeding one year, or fined not more than $5,000,

or both, and may be fined a further sum equal to the money so

loaned or gratuity given.

“Any examiner Or assistant examiner who shall accept a loan or

gratuity from any bank examined by him, or from an officer,

director, or employee thereof, or who shall steal, or unlawfully take,

or unlawfully conceal any money, note, draft, bond, or security or

any other property of value in the possession of any memt>or bank or

from any safe deposit box in or adjacent to the” premises of such

—–v* -**.r ,•/%

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

bank, shall be deemed guilty of a misdemeanor and Bfrall, upon

conviction thereof m any district court of the United States, be

imprisoned for not exceeding one year, or fined not more than

$5,000, or both, and may be fined a farther sum equal to the money

so loaned, gratuity given, or property stolen, and shall forever

thereafter be disqualified from holding office as a national bank

examiner.”

Sec. 16. That section 24 of the Federal Reserve Act be amended

to read as follows:

“ Sec. 24. Any national banking association may make loans

secured by first lien upon improved real estate, including improved

farm land, situated within its Federal reserve district or within a

radius of one hundred miles of the place in which such bank is

located, irrespective of district lines. A loan secured by real estate

within the meaning of this section shall be in the form of an

obligation or obligations secured by mortgage, trust deed, or other

such instrument upon real estate when the entire amount o f such

obligation or obligations is made or is sold to such association. The

amount of any-such loan shall not exceed 50 per centum of the

actual value of the real estate offered for security, but. no such loan

upon such security shall be made for a longer term- than five years.

Any such bank may make such loans in an aggregate sum including

in such aggregate any such loans on which it is liable as indorser or

guarantor or otherwise equal to 25 per centum of the amount of the

capital stock of such association actually paid in and unimpaired

and 25 per centum of its unimpaired surplus fund, or to one-half

of its savings deposits, at the election of the association, subject to

the general limitation contained in section 5200 of the Revised

Statutes of the United States. Such banks may continue hereafter

as heretofore to receive time and savings deposits and to pay

interest on the same, but the rate of interest which such banks

may pay upon suoh time deposits or upon savings or other deposits

shall not exceed the maximum rate authorized by law to be

paid upon 6uch deposits by State banks or trust companies organized

under the laws o f the State wherein such national banking association

is located.”

Seo. 16. That section 5139 of the Revised Statutes of the United

States be amended by inserting in the first sentence thereof the

following words: ‘‘ or into shares of such less amount as may be

provided in the articles: o f association ” so that the section as amended

shall read as follows:

“ Sec. 5139. The capital stock of each association shall be divided

into shares of $100 each, or into shares o f such less amount as may

be provided in the articles of association, and be deemed personal

property, and transferable on the books of the association in such

manner as may be prescribed in the by-laws or articles of association.

Every person becoming a shareholder by such transfer shall, in

proportion to his shares, succeed to all rights and liabilities of the

prior holder of such shares; and no change shall be made in the

articles of association by which the rights, remedies, or security of

the existing creditors of the association snail be impaired.”

Sf.c. 17. That section 5146 of the Revised Statutes of the United

States as amended be amended by inserting in lieu of the second

10 IPOT-W

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

(Pub. m. 11

sentence thereof the following: “ Evenr director must, own in his

own right shares of the capital stock of the association of which he

is a director the aggregate par value of which shall not be less than

$1,000, unless the capital of the bank shall not exceed $25,000 in

which case he must own in his own right shares of such capital

stock the aggregate value of which shall not be less than $500,” so

that the section as amended shall read as follows:

a Sec. 5146. Every director must during his whole term of service,

be a citizen of the United States, and at least three-fourths of

the directors must have resided in the State, Territory, or District

in which the association is located, or within fifty miles of the location

of the office of the association, for at least one year immediately

preceding their election, and must be residents of such State or

within a fifty-mile territory of the location of the association during

their continuance in office. Every director must own in his own

right shares of the capital stock of the association of which he is a

director the aggregate par value of which shall not be less than

$1,000, unless the capital of the bank shall not exceed $25,000 in

which case he must own in. his own right shares of such capital stock

the aggregate par value of which shall not be less than $500. Any

director who ceases to be the owner of the required number of shares

of the stock, or who becomes in any other manner disqualified, shall

thereby vacate his place.”

Skc. 18. That the second subdivision of the fourth paragraph of

section 4 of the Federal Reserve Act be amended to read as follows:

“ Second. To have succession after the approval of this Act until

dissolved bv Act of Congress or until forfeiture of franchise for

violation of law.”

Sec. 19. That section 3 of the Federal Reserve Act, as amended,

is further amended by adding at the end thereof the following:

44 The Federal Reserve Board may at any time require any Federal

Reserve Bank to discontinue any “branch of such Federal Reserve

Bank established under this section. The Federal IWerve Bank

shall thereupon proceed to wind up the business of such branch bank,

subject to such rules and regulations as the Federal Reserve Board

may prescribe.”

Approved, February 25, 1927.

Digitized for FRASER

http://fraser.stlouisfed.org/

Federal Reserve Bank of St. Louis

Commentaires récents