Campaign for Monetary Reform – News from Switzerland

new website in support of the monetary reform initiative it plans to

launch in Spring 2014.

Initiative) which enables Swiss citizens to launch an initiative aimed

at changing specific provisions within the Swiss Constitution. To do so

requires first of all the collection within an 18 month period of

100’000 valid signatures in support of the initiative. Should this

hurdle be surmounted, the initiative would then be put to a national

vote.

way, including the draft proposed amendments to the Swiss Constitution.

In a nut shell, the proposal extends the Swiss Federation’s existing

exclusive right to create coins and notes, to also include deposits. With the full power of new money creation exclusively in the hands of the Swiss National Bank,

the commercial banks would no longer have the power to create money

through lending. The Swiss National Bank’s primary role becomes the

management of the money supply relative to the productive economy, while

the decision concerning how new money is introduced debt free into the

economy would reside with the government. As is evident from the

foregoing, the MoMo monetary reform initiative is essentially based on

the monetary reform advocated by PositiveMoney.

of the campaign, or who would like to understand the detailed

provisions, including those relating to the transition period, please

refer to the campaign website.

The website is in German so language will present a limitation for many

of you. Nevertheless, we do encourage you to visit the website and if

you have specific questions, to leave a message in English. Someone from

the team who speaks English will get back to you. The biggest challenge

for the team at this stage of the campaign is to find the needed help

and financing for signature collection. The minimum amount of funding

required for a successful campaign is estimated to be 400’000 CHF or

just over 270’000 GBP. Although, this is a non-UK initaitive, should the

MoMo team succeed in putting such a fundamental reform proposal to a

national vote, this would be a momentous achievement for the monetary

reform movement in Europe and across the globe. All eyes would be fixed

on Switzerland, because success for this small but significant player

in the financial arena would inevitably have a ripple effect in other

countries.

-

Thousands of honest and hard working citizens are saddled with debts and living at or beneath the poverty line. At the same time the government is shaving funding from citizen priorities such as health care, education, unemployment benefits, job creation initiatives, new start-up enterprise assistance incubators, environmental protection, infrastructure maintenance and local public transportation. As well, at a time when Switzerland more frequently finds herself isolated on the inter-continental (European Union) and international stage, the government continues to slash public support to our diplomatic and embassy bureaus and our Post office modernization. Pension funds continue to be under funded and in some cases are being stripped of their assets. In this environment I it any wonder that our cherished bonds of cohesion and solidarity are fraying?

-

The above “solutions” are part of a long series of sneaky, underhanded forms of money grabbing through more efficient and effective parking meters, automated speed and other traffic code revenue generation automation in conjunction with a host of new user pays licences and registration requirements across all pastimes and activities. As well the regressive sales tax, jokingly called “Value added” has been increased while the categories exempted have been reduced, penalizing all citizens but particularly the poorest as well as the once vibrant small and medium size enterprises (MSE) faced with reduced customer purchase revenues and increased regulatory costs. This reality has reduced both current employed numbers and positive expectations for the future, particularly among the young and recent graduates.

-

Meanwhile the economic reality of production of goods and services, thanks to the many discoveries and inventions such as computers and robots is a constantly more efficient economic system producing a greater abundance of these goods and services but also dramatically reducing the human input required. This off course results in a not infrequent over production of goods, while at the same time reducing the number of jobs and human hours of work required. A growing proportion of the population is thus deprived of their “pay-cheque”, their only means to acquire the goods created within and by their own communities. This unfortunately tempts and forces some into activities for money that are shameful and or illegal.

-

A new crisis at Union de Banques Suisses or any too big to fail banks could necessitate billions in Federal Council emergency funds underwriting the gambling losses of such bank. This means that generations of current and future taxpayers will be paying for the bank’s mistakes, and also get to pay interest on this privilege! So let’s stop right here and add up what we’ve looked at so far: production results and capacity are abundant having wisely built on our long traditions of inventiveness and innovation, particularly in the processes and equipment used in production; this progress while good in itself, had dramatically reduced the demand for human input , therefore employee or wage workers. This means for many either a reduced pay cheque due to reduced hours or no job now nor in the future. No pay cheque means no means to acquire the good which are being more abundantly produced. Meanwhile, despite having less and less “pay cheque” money, we are being subjected to higher and higher punitive surveillance and regulatory requirements and fees. And now, let’ get this right, the small minority that has excessive amount of pay cheque money, dividends from un-taxed trust funds, huge returns from capital invested who knows where and in what, the ones who guessed wrong or gambled unconsciously requiring these massive tax subsidized bailouts further reducing all our disposable or purchasing totals, these same people profit again by pushing down the price they pay for products and services since there are fewer and fewer buyers? Does this all add up for you? No, well it doesn’t seem to be adding up any better for the hundreds of thousands, millions of our fellow humans taking to the streets in Ireland, Greece, Portugal, Spain, Italy, anywhere in Europe. If we widen our scope we quickly see it isn’t adding up anywhere else in the world either.

-

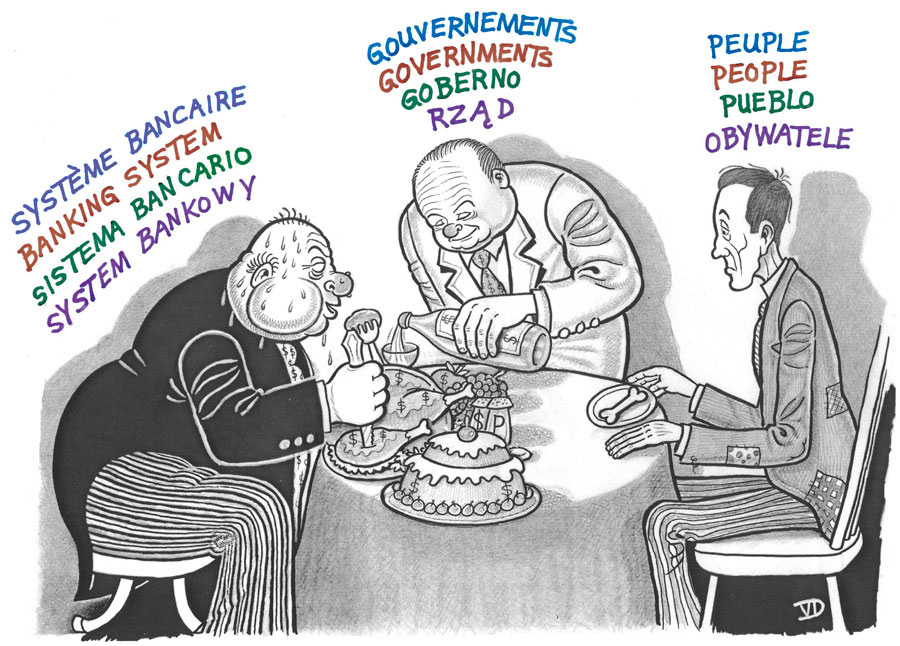

Two Archetypes of this dysfunctional system are the privately owned Federal Reserve Bank of America and its privately chartered collection agency the Internal Revenue Service (IRS) These systems were both designed by international bankers and vested individuals who through verbal duplicity and ambiguity to tricked the unsuspecting American citizens by their Congressional representatives to permit the “FED” exactly a hundred years ago in December 1913. These two archetype are representative of the “Too big to Fail” syndrome so familiar today—their toxic assets create by the perverse mechanism of private money creation from nothing are hailed as saviours of the sovereignty. For more than three centuries a small elite group has been creating billions and billions of dollar, francs, yen, based debts for all of us, plus interest off course, using our properties, homes, businesses and public treasures and common infrastructures. They get the cash, we get the debt! Our debt, besides being morally depraved, is also mathematically impossible to re-pay. Every culture recognizes, as do all the moral codes, that contracts which by their terms of required performance are impossible to perform are void from the outset!!All sovereign jurisdictions and many corporations, families and individuals are beyond the point of no return due to this abdication of responsibility in the past at the sovereign or nation state level. The few nations that have recently tried to resist , such as Libya, have been bombed back into the stone ages of anarchy, destitution and hopelessness. This lopsided global system of systemic boom (new debts “borrow money to make money”) to bust ( dramatic contraction of the money supply) is not an “invisible hand” any longer. The liars’ talk of “fiscal responsibility” was conceived in inequity and implemented knowingly or unknowingly with the majority of head of state, elected representatives and international governing bodies such as the World Bank and International Monetary Fund (IMF) . Will we continue with our children and their children to be slaves of this self appointed banking “elite” who have created the life blood of our economic exchange system (money) putting nothing in and yet essentially controlling everything?

-

THERE ARE SOLUTIONS CURRENTLY BEING PROMOTED HERE IN SWITZERLAND

To further reposition “money” from it current god-like, idolatrous status ruling mankind to its proper role as a useful tool serving all mankind, a number of provisions will be introduced restricting trading on margin, “short selling” credit default swaps etc. The key principle to be employed will include i)full existing title of ownership and ii)full payment. To reduce arbitrage trading {EDITOR; arbitrage trading is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance; traders have been known to buy and sell in the same two areas hundred of times in a single day taking advantage of their not paying any transaction costs to capitalize of minute second by second price swings ]) in both stocks and currencies a price will be listed for the day A number of sophisticated reforms a outlined by Maurice Allais, French Nobel Prize winner in Economics the thrust of which is to return the gambling mindset” from financial instrument and markets, a mindset, that while it ha always been present in the minds and actions of a few, has since the early nineteen seventies grown into endemic proportion to the extent that it may very well being the standard governing principle—the lives and livelihoods of billions of us being determined by a few who look on life as nothing but one giant ,non-top casino.

Commentaires récents